Dollar-Cost Averaging A Smart Investment Strategy For Individual Investors

Dollar cost averaging is a popular investment strategy that can be used by both novice and experienced investors. It is a passive investing approach that involves purchasing a fixed dollar amount of a particular investment regularly over a given time period. It is also often referred to as systematic investing or automatic investing.

The process of dollar cost averaging can be broken down into three primary stages: definition, how to, and tips.

Definition

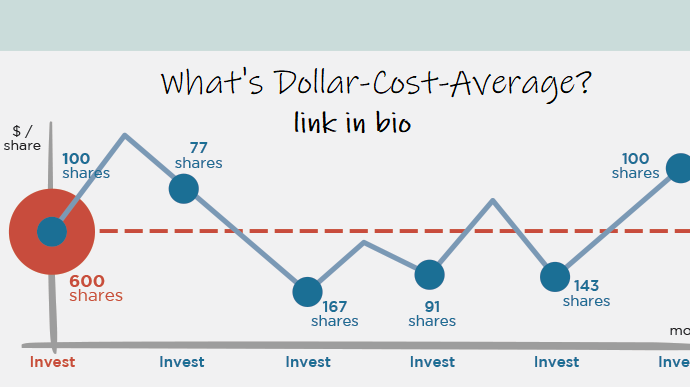

Dollar cost averaging can be defined as investing a fixed amount of money on a periodic basis regardless of the price of the investment. This means that an investor can continue buying the same amount of shares at regular intervals, regardless of whether the market is expensive or cheap.

With dollar cost averaging, an investor spreads out the investment over time, allowing the effects of market volatility to be averaged out over the entire investment period. Over time, this approach can lead to gains due to the compounding effect of reinvested dividends and capital appreciation.

How to

Firstly, the investor should decide on the investment that they wish to make. This could be a particular stock, ETF, or mutual fund.

Next, the investor should determine the amount they wish to invest on a regular basis. This could be as little as $50 per month, but ideally should be enough to buy one share of the investment at a time.

Once the investor has determined the investment and the regular investment amount, they should set up an automatic investment plan. This can be done with the investor's broker or investment firm, and will automatically invest the set amount on a regular interval, such as weekly or monthly.

It is important that the investor sticks to their investment plan and does not try to time the market. This means that they should continue to invest regularly, even during market downturns or when the investment price is high.

Tips

There are a number of tips that investors should consider when using the dollar cost averaging strategy:

- Choose investments wisely: It is important to select investments that have a good long-term growth potential, and that align with the investor's long-term investment goals.

- Set the investment amount carefully: The investor should calculate how much they can afford to invest on a regular basis, and ensure that this amount is sufficient to buy at least one share of the investment they have selected.

- Stick to the investment schedule: Once the investor has established their automatic investment plan, it is important that they stick to it, regardless of market conditions. This will ensure that they benefit from market volatility and can take advantage of long-term growth.

- Consider taxes: The investor should be aware that they may be liable for taxes on any dividends or capital gains that they receive from their investment. They should consider the tax implications of their investment strategy, and seek professional advice if necessary.

- Monitor the investment: It is important that the investor regularly monitors their investment to ensure that it is on track to achieve their long-term goals. They should consider making adjustments if their investment performance falls short of expectations.

In conclusion, the dollar cost averaging strategy is a simple and effective way to invest in the stock market. It allows investors to spread out their investment over time, reducing the risk of market volatility, and potentially leading to long-term gains. By following the tips outlined above, investors can maximize the benefits of this strategy and achieve their long-term investment goals.

Post a Comment for "Dollar-Cost Averaging A Smart Investment Strategy For Individual Investors"