Investing In Foreign Stocks Diversifying Your Portfolio Globally

Building a successful investment portfolio requires a lot of effort, patience and an understanding of the market. When creating a portfolio, it is important to ensure that it is diverse enough to limit one's exposure to risk factors. In this post, we will explore the concept of portfolio diversification, and how it can reduce the risk involved in investing.

Definition

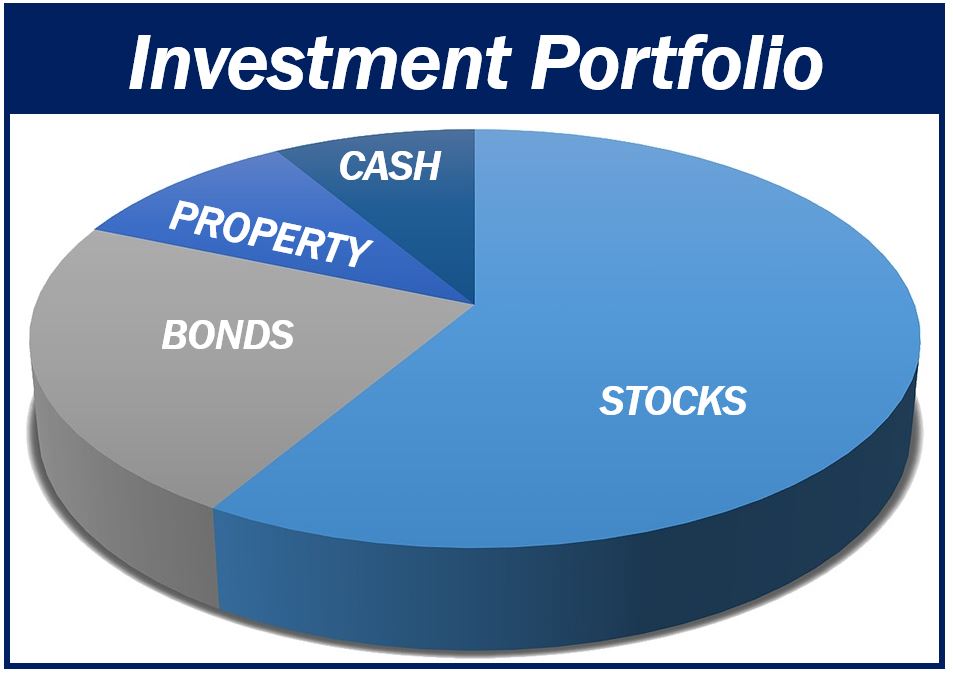

Portfolio diversification refers to the practice of spreading your investments among different types of assets. This means that instead of investing all your money in a single stock or asset, you allocate a percentage of your investments to various stocks, bonds, and other assets. By diversifying your investments across different assets, you can reduce the risk of losing all your money in a single investment.

It is important to note that diversification does not guarantee profits or eliminate risk. However, it does provide investors with the opportunity to minimize their losses and potentially earn greater returns over the long term.

How to Diversify Your Portfolio

Before you begin diversifying your portfolio, it is important to establish your investment goals, time horizon, and risk tolerance. This will help you determine the asset allocation that is right for you.

One way to diversify your portfolio is to invest in different sectors of the economy. For instance, you can invest in stocks of technology companies, energy companies, financial institutions, or healthcare companies. By doing this, you spread your investments across different industries and minimize the impact of adverse events in one sector.

Another way to diversify your portfolio is to invest in different types of securities, such as stocks, bonds, mutual funds, real estate, and commodities. Diversifying across different types of assets is important because each asset class responds differently to various market conditions. For example, when the stock market is experiencing volatility, bonds tend to provide more stability and consistent returns.

Investing in different geographic regions is also an effective way to diversify your portfolio. This can be accomplished by investing in international stocks, mutual funds, or ETFs. By diversifying globally, you can minimize the risk of investing in a single region or country, and benefit from growth opportunities around the world.

Tips for Effective Portfolio Diversification

While diversification is a powerful strategy for reducing risk, it is important to do it effectively. Here are some tips to help you diversify your portfolio:

- Set realistic goals: Establish clear and realistic investment objectives based on your financial goals, risk tolerance, and time horizon.

- Get professional advice: If you are new to investing or you find it difficult to manage your portfolio, consider getting help from a professional financial advisor.

- Invest in low-cost funds: Focus on low-cost index funds, ETFs or mutual funds to minimize your expenses associated with investing.

- Rebalance your portfolio regularly: Review your portfolio periodically and make necessary adjustments to ensure that your investments stay in line with your investment goals and objectives.

- Stay disciplined: Stick to your investment plan and avoid making impulsive investment decisions based on short-term market trends.

Diversifying your investment portfolio can help you mitigate risk and achieve your financial goals over the long-term. However, remember that there is no one-size-fits-all strategy and that diversification alone is not enough to ensure investment success. It is important to stay informed about market developments, monitor your investments regularly, and seek professional advice when necessary.

Now that you have a better understanding of portfolio diversification, it's time to take action and diversify your investments. Good luck!

Post a Comment for "Investing In Foreign Stocks Diversifying Your Portfolio Globally"