Investing In High-Yield Bonds Risks And Rewards

Investing in bonds is an important consideration for those looking to create a well-balanced retirement portfolio. While bonds are typically seen as a safe and stable investment option, they do come with their fair share of risks. In this article, we’ll explore the potential dangers of investing in bonds, as well as how to minimize your risk and optimize your returns.

Definitions

Before diving into the risks associated with investing in bonds, it’s important to first define what bonds are and how they work. Essentially, bonds are a form of debt in which an investor loans money to a corporation, government, or other entity. In exchange for the loan, the debtor promises to make regular interest payments and eventually repay the full amount of the loan.

One of the primary benefits of investing in bonds is the steady income stream they can provide. Bondholders receive regular interest payments, which can be reinvested to grow their wealth over time. Additionally, bonds are typically less volatile than other types of investments, like stocks, which can provide a sense of stability and security for investors.

Potential Risks

While bonds may seem like a safe and stable investment, there are a number of risks that investors should be aware of. One of the primary risks associated with bonds is interest rate risk. Essentially, this means that if interest rates rise, the value of existing bonds will decrease. This is because investors will demand higher interest rates for new bonds in order to compensate for the increased risk. As a result, the value of existing bonds will fall to reflect their lower relative value.

Another risk associated with bonds is credit risk. This refers to the possibility that the debtor may default on their loan and be unable to repay the full amount owed. If this happens, bondholders may lose a portion or all of their investment. This risk is particularly high for corporations or governments that have a poor credit rating or financial stability.

A third risk associated with investing in bonds is reinvestment risk. Essentially, this refers to the possibility that an investor will be unable to reinvest the proceeds from a bond that has matured at a comparable interest rate. This can result in reduced returns or a loss of income for the investor.

Minimizing Risk

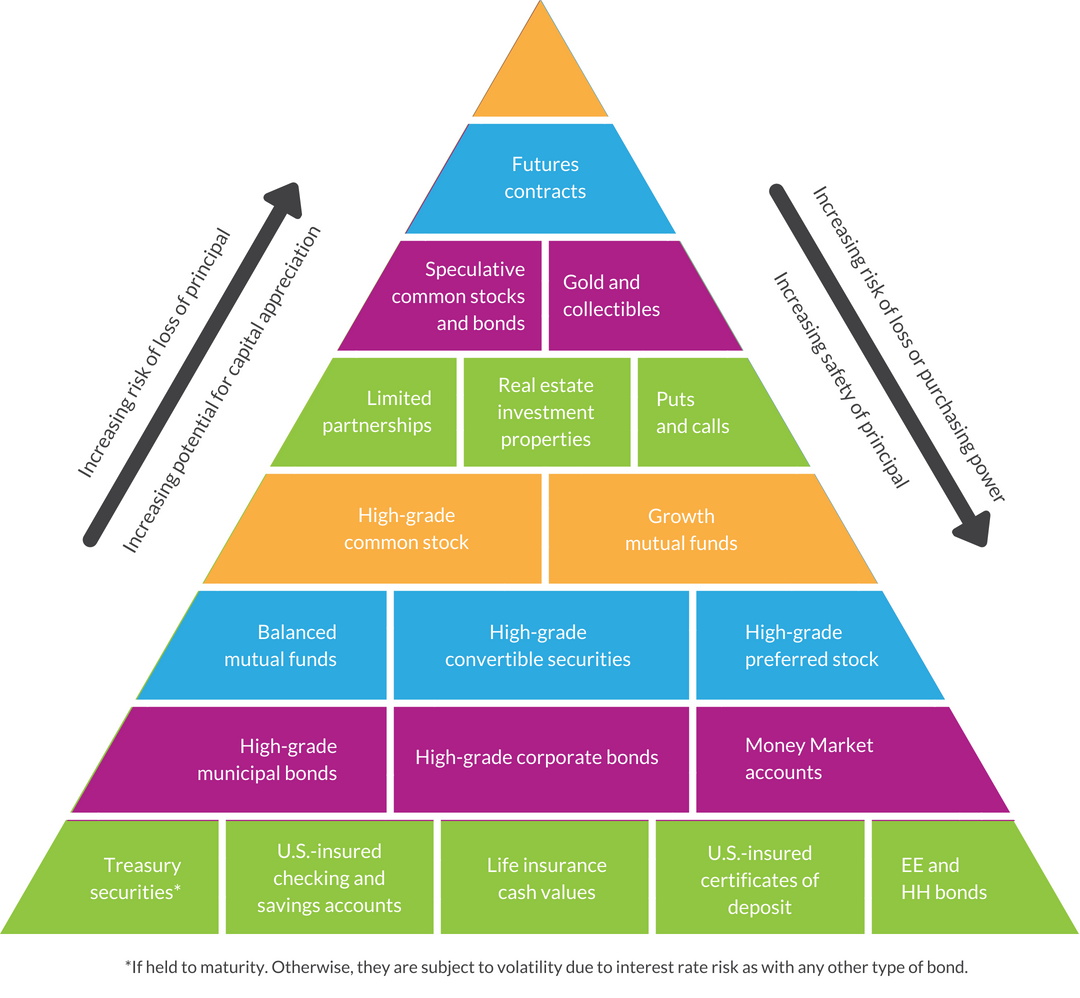

While there are certainly risks associated with investing in bonds, there are also steps that investors can take to mitigate their risk and optimize their returns. One key strategy is to diversify your bond portfolio. This means investing in a variety of different bonds from different issuers, with varying interest rates and maturities. By diversifying, you can spread your risk across multiple investments and reduce the impact of any one bond’s default.

Another strategy is to pay attention to the credit rating of the debtor. Bonds that are issued by entities with a higher credit rating are generally considered to be less risky, as they are more likely to be able to repay their debts. Additionally, choosing bonds with shorter maturities can help reduce interest rate and reinvestment risk.

Finally, it’s important to stay up-to-date on market trends and changes in interest rates. By monitoring the market, you can make informed decisions about when to buy or sell bonds in order to maximize your returns.

Tips for Investing in Bonds

Investing in bonds can be a great way to build a stable income stream and grow your wealth over time. However, it’s important to approach bond investing with caution and a strong understanding of the risks involved. Here are a few tips to keep in mind:

- Diversify your portfolio by investing in a variety of bonds from different issuers.

- Pay attention to the credit rating of the debtor to minimize credit risk.

- Choose bonds with shorter maturities to reduce the impact of interest rate and reinvestment risk.

- Stay up-to-date on market trends and changes in interest rates.

By taking these steps, you can minimize your risk and maximize your returns when investing in bonds.

Conclusion

Investing in bonds can be a great way to create a stable and secure retirement portfolio. However, it’s important to approach bond investing with caution and a strong understanding of the risks involved. By diversifying your portfolio, paying attention to credit ratings, and staying up-to-date on market trends, you can mitigate your risk and optimize your returns when investing in bonds.

Post a Comment for "Investing In High-Yield Bonds Risks And Rewards"