Investing In Options Trading Risks And Opportunities

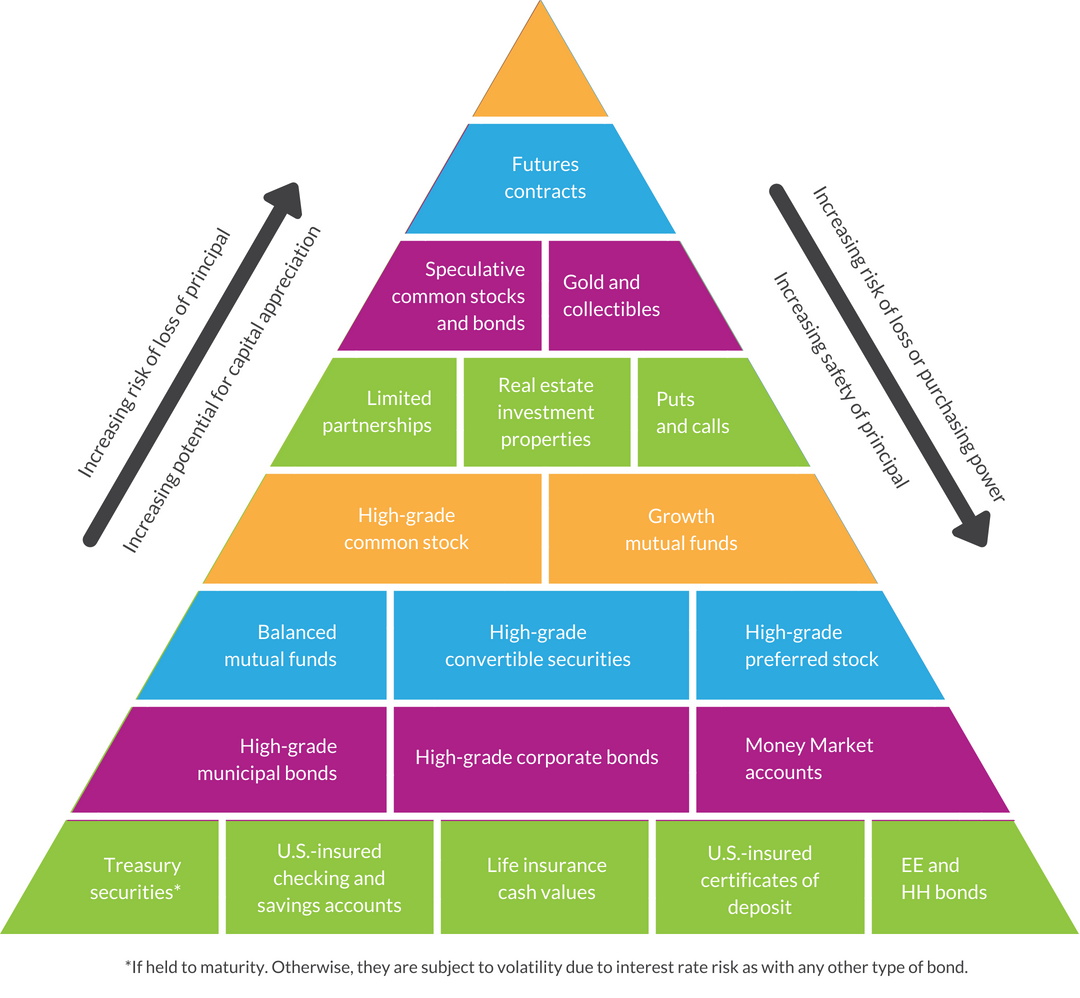

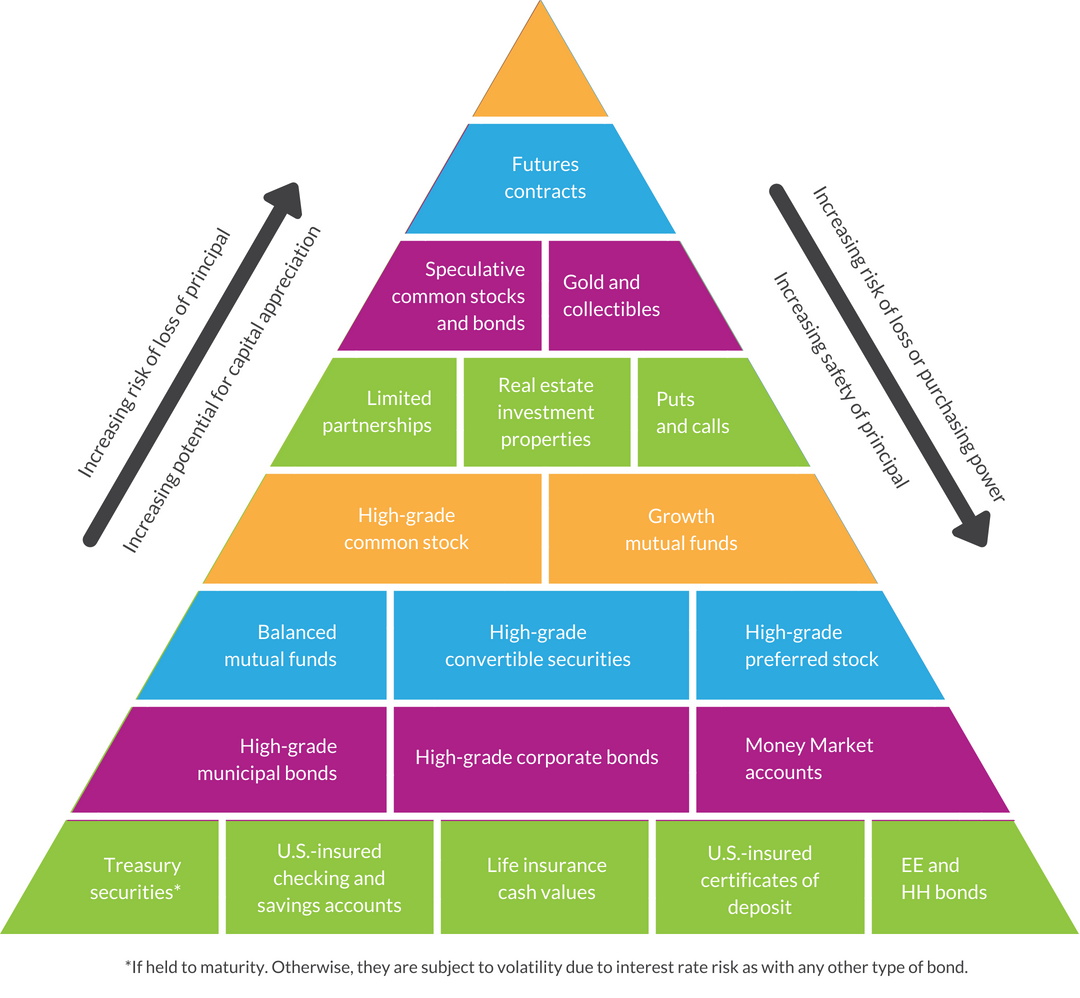

When it comes to investing, it's important to understand the different options available to you. Whether you're looking to diversify your portfolio or build long-term wealth, there are a variety of investment vehicles to consider.

Let's start with the basics: stocks, bonds, and other securities. Stocks represent ownership in a company, giving you a stake in its performance and profits. Bonds, on the other hand, are debt securities that provide regular interest payments and are typically considered lower risk than stocks.

Other securities include mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). These can provide exposure to a diverse range of assets and can be a great option for those looking for a more hands-off investment approach.

How to Get Started Investing

If you're new to investing, it can seem overwhelming. But with a little bit of research and planning, you can get started on the right foot. Here are some tips to help you get started:

Set Your Goals

Before you start investing, it's important to know what you're investing for. Are you saving for retirement? Planning to buy a house? Looking to build wealth over the long-term? Once you have a clear idea of your goals, you can begin to choose investments that align with those goals.

Choose Your Strategy

There are a variety of investment strategies out there, from growth investing to value investing to index fund investing. Each strategy has its advantages and disadvantages, so it's important to do your research and choose a strategy that aligns with your goals and risk tolerance.

Research Investments

Before you invest your hard-earned money, it's important to research your options. Look at factors like past performance, fees, and risks associated with each investment. You can also seek the advice of a financial professional to help guide your choices.

Start Small

Investing doesn't have to be an all-or-nothing endeavor. Start by investing a smaller amount of money and gradually increase your investments over time. This can help you get comfortable with the process and avoid making mistakes that could cost you in the long run.

Tips for Successful Investing

Investing is a journey, and there are steps you can take to help ensure success along the way. Here are some tips to keep in mind:

Stay Diversified

Diversification is key in investing. By spreading your investments across different asset classes and sectors, you can help minimize risk and maximize potential returns.

Stick to Your Plan

Once you've established a plan and chosen your investments, it can be tempting to make changes based on market fluctuations or news headlines. But sticking to your plan can help you avoid making emotional, knee-jerk decisions that could harm your portfolio in the long run.

Be Patient and Consistent

Investing takes time, and it's important to be patient and consistent in your approach. By investing regularly and sticking to your plan over the long-term, you can help ensure better results and achieve your financial goals.

In conclusion, investing can be a great way to build wealth over the long-term. By understanding your goals, choosing the right strategy, and doing your research, you can set yourself up for success. And by staying diversified, sticking to your plan, and being patient and consistent, you can help ensure that your investments work for you in the years to come.

Post a Comment for "Investing In Options Trading Risks And Opportunities"