Investing In Real Estate Crowdfunding A Guide To Passive Investing

A passive real estate investment may sound like a dream come true - steady cash flow without having to lift a finger. However, before you jump into any deal, there are some important things you need to know.

Definition

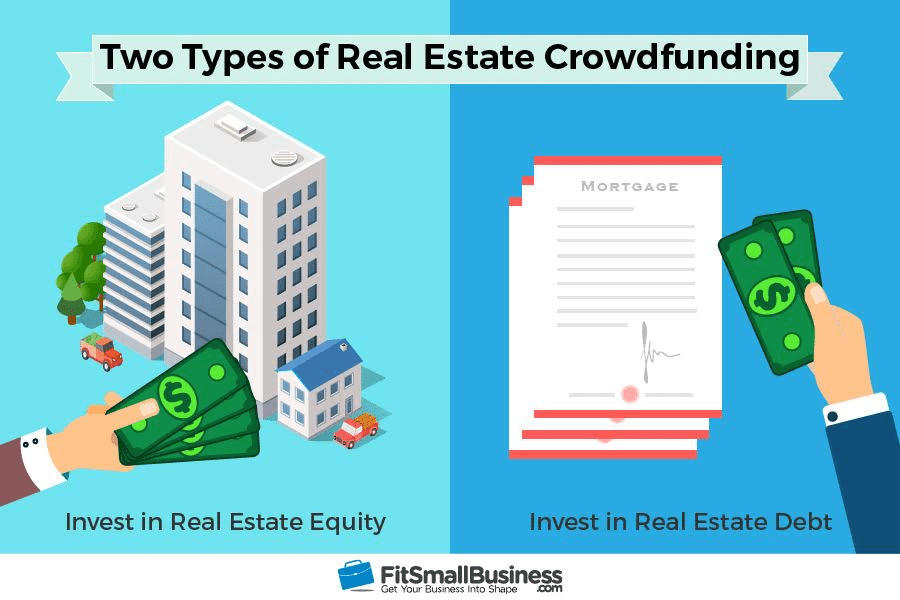

A passive investment in real estate means that you are investing in a property without being actively involved in its day-to-day management. This could mean investing in a real estate syndicate or a Real Estate Investment Trust (REIT).

How to Invest

Firstly, get educated about the industry. Understanding the basics of real estate investing will help you ensure that the deal is right for you. Look for quality educational resources such as books, online courses, and podcasts that focus on this niche investment category.

Next, start networking with other investors. Check out local real estate investment clubs and attend industry events. Learn from other people's experiences, mistakes and successes.

Make sure you also know what you are looking for in a deal. Know the market, property type, and class you want to invest in. This will help make sure that you are working with the right people and your expectations are aligned.

Once you have found a deal that you are interested in, thoroughly evaluate it both on paper and in person. The numbers need to add up and the property should be in good condition. You don't want to be stuck with a money pit.

Tips

1. Always have an exit strategy.

You never know when circumstances might change, so always have a plan in place for how and when you will exit the deal.

2. Do not limit yourself to local deals only.

You could find better deals in other areas or states, so long as you also do your due diligence and understand the local market dynamics.

3. Be aware of the risks involved.

Any investment comes with risks, but with passive real estate investments, you don't have the control to mitigate those risks. So be aware of the risks you are taking on.

4. Manage your expectations.

Many people expect passive real estate investments to generate immediate and high returns. While the returns can be steady, expect them to be more of a slow-and-steady growth rather than a quick return on investment.

5. Work with the right partner.

With passive investments, you rely on others to manage the property or investment. Choose your partner carefully and ensure their goals and values align with yours.

Overall, a passive real estate investment can be a great way to earn passive income, but it is important to do your due diligence and be aware of the potential risks involved. By following these simple steps, you can make sure that you find the right deal and invest wisely.

Post a Comment for "Investing In Real Estate Crowdfunding A Guide To Passive Investing"