Investing In REITs Real Estate Investment Trusts

Hey there fellow investors! Are you looking for ways to diversify your portfolio and earn passive income? Look no further than Real Estate Investment Trusts, or REITs. In this post, we'll define what REITs are, explain how to invest in them, and give you some valuable tips to make the most out of your investment.

Definition

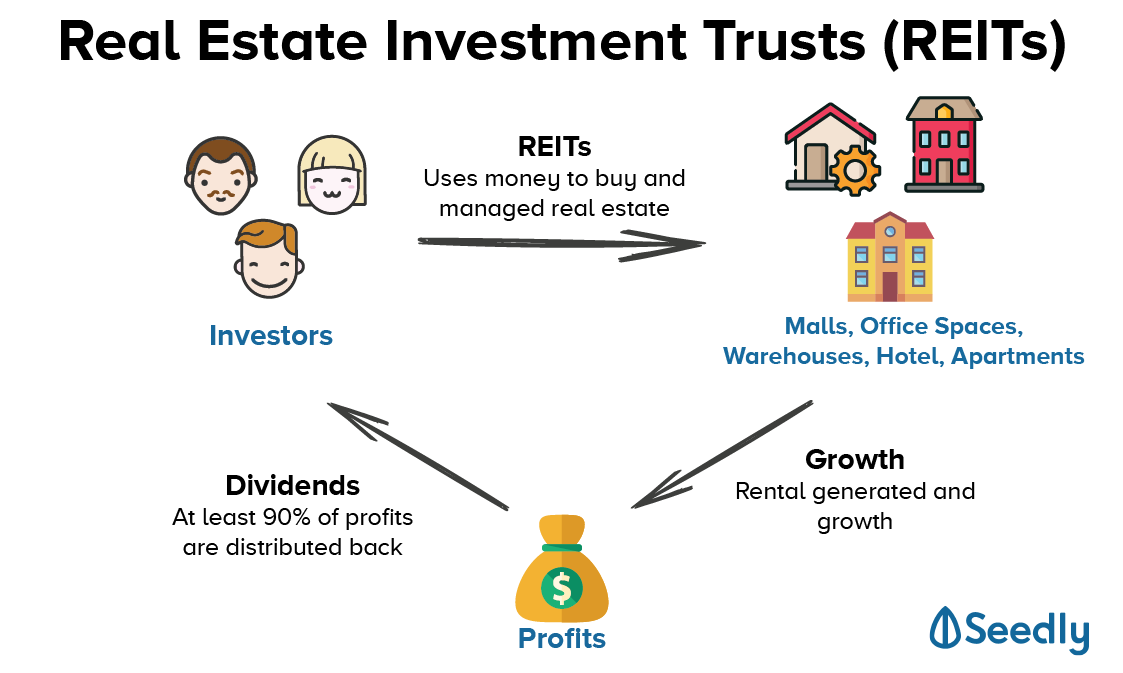

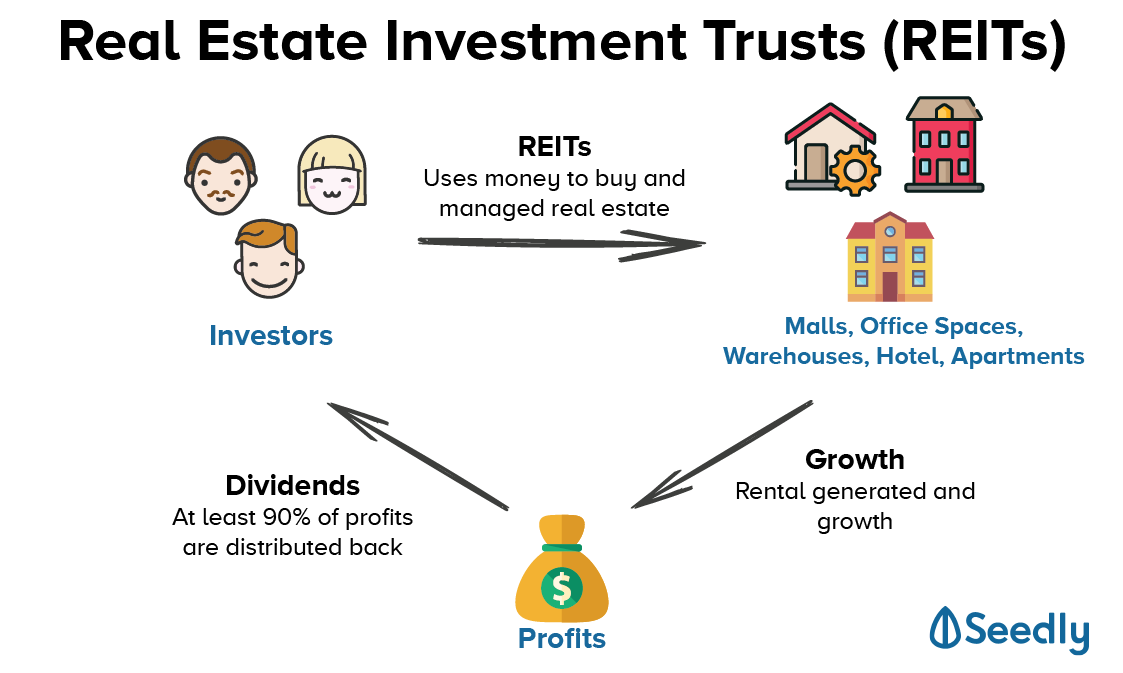

REITs are companies that own or finance income-producing real estate. By investing in REITs, you can earn a share of the income produced by the underlying properties without actually having to own them yourself. REITs are required to pay out at least 90% of their taxable income to shareholders in the form of dividends, which makes them a great source of passive income.

How to

Investing in REITs is easy and accessible to everyone, even if you don't have a lot of capital. Here are the steps you can follow:

- Open a brokerage account: You will need a brokerage account to buy and sell REITs. You can either choose an online broker or a traditional one. Make sure to research and compare fees, account minimums, and available tools before choosing.

- Research and choose REITs to invest in: Look for REITs that own properties in sectors you are interested in, such as residential, commercial, industrial, or healthcare. Check the REIT's financials and performance history before investing.

- Place your order: Once you have chosen the REITs you want to invest in, simply place your order through your brokerage account. You can either buy a few shares or a whole lot, depending on your budget and investment goals.

- Monitor your investment: Keep track of the performance of your REITs and any news or events that may affect them. You can also set up automatic dividend reinvestment to compound your earnings over time.

Tips

Here are some tips to help you make the most out of your REITs investment:

- Diversify your portfolio: Invest in different REITs and real estate sectors to minimize risk and increase returns.

- Check the dividend yield: Look for REITs with a solid track record of paying dividends and a high yield. But be wary of yields that are too good to be true, as they may not be sustainable.

- Watch out for expenses: Be aware of the fees and expenses associated with your REITs investment, such as management fees, brokerage fees, and taxes.

- Stay informed: Keep up-to-date with the latest news and trends in the real estate market and the economy as a whole. This will help you make informed decisions about your REITs investment.

Investing in REITs can be a great way to earn passive income and diversify your portfolio. By following these tips and doing your own research, you can make smart investment decisions and enjoy the benefits of real estate ownership without the hassle of actually owning property. Happy investing!

/GettyImages-1005011746-25886837be3e4e2a832c8c0bd1eb4b59.jpg)

Post a Comment for "Investing In REITs Real Estate Investment Trusts"