Investment Renaissance: Adapting To The Modern Economy

Welcome to our blog post! Today, we would like to discuss an interesting topic that revolves around investment in Africa. We have come across a fascinating chart titled "Investment Renaissance" from the tralac trade law centre, which highlights the current state of investment in the region.

Investment in Africa has been experiencing a significant renaissance in recent years. This chart provides valuable insights into the various factors influencing this renewed interest in the continent. Let's dive deep into the data to understand the trends and implications.

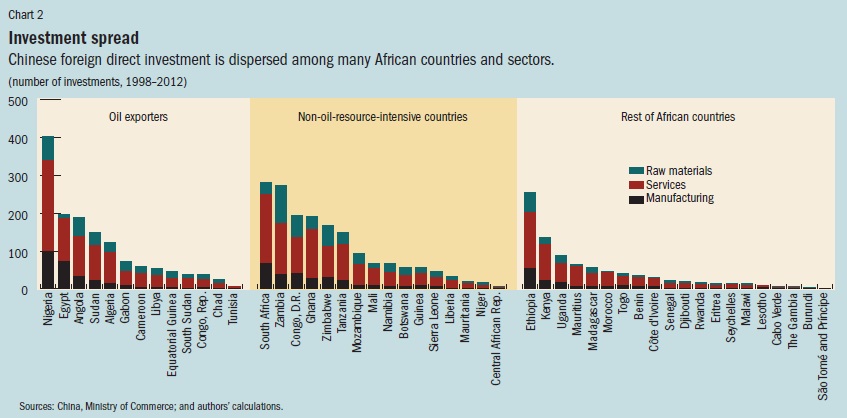

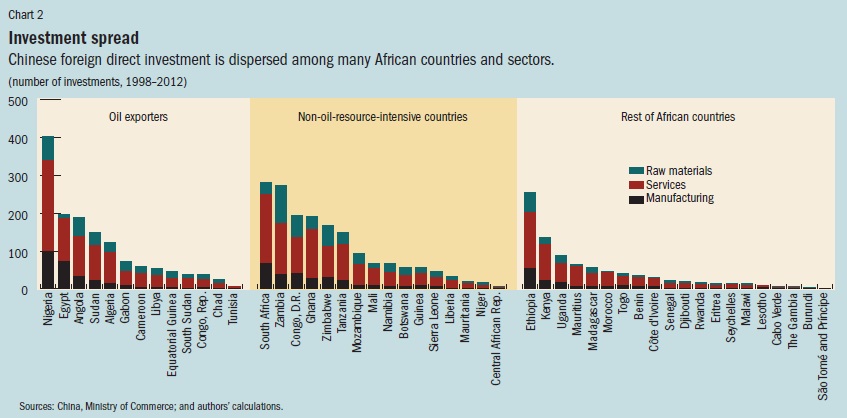

The first key observation from the chart is the increasing foreign direct investment (FDI) flowing into Africa. This investment trend signifies a recognition of the continent's potential for growth and a shift in perception regarding the risks associated with investing in Africa.

Furthermore, the chart reveals the sectors that have been attracting substantial investment. These sectors include technology, infrastructure, renewable energy, and manufacturing. The growth of these industries is essential for Africa's economic development, job creation, and sustainable future.

What is driving this investment renaissance in Africa?

There are several factors contributing to this positive trend. Firstly, the continent has experienced improvements in political stability and governance, leading to a more conducive business environment. Additionally, Africa's young and rapidly growing population presents a tremendous opportunity for consumer-driven industries and a potential market of significant scale.

The abundance of natural resources in Africa also plays a crucial role in attracting investment. From minerals and fossil fuels to agricultural produce, the continent possesses a wealth of resources that are essential for global economic activities. This has led to increased interest from both traditional and emerging economies seeking to secure access to these resources.

Tips for investors considering Africa as a potential investment destination:

1. Conduct thorough research: Understand the market dynamics, geopolitical factors, legal framework, and economic indicators of the specific country or countries you are interested in investing in.

2. Establish local partnerships: Collaborating with local businesses not only brings local knowledge and expertise but also helps navigate cultural differences and mitigate potential risks.

3. Identify growth sectors: Identify sectors with high growth potential, such as technology, agriculture, renewable energy, and consumer goods, and align your investment strategy accordingly.

4. Consider long-term objectives: Investment success in Africa often requires a long-term perspective. Be patient and committed to building sustainable businesses that create value for both shareholders and local communities.

Recommendation:

Africa offers a multitude of investment opportunities across various sectors. To harness the full potential of this investment renaissance, it would be wise to consider investing in Africa-focused funds or engage the services of financial institutions with expertise in the region. These entities can provide guidance, access to local markets, and mitigate some of the risks associated with investing in emerging markets.

Listicle of the top reasons to invest in Africa:

- Affordable labor market

- Vast natural resources

- Emerging middle class

- Positive demographic trends

- Infrastructure development

- Improved political stability

- Untapped potential in various sectors

- Growing consumer market

Question & Answer:

Q: What are the risks associated with investing in Africa?

A: Investing in Africa does come with certain risks, such as political instability, corruption, inadequate infrastructure, and regulatory challenges. However, these risks can be managed through thorough due diligence, local partnerships, and a long-term investment perspective.

Summary:

In conclusion, Africa is currently experiencing an investment renaissance, with increasing foreign direct investment and a focus on various sectors such as technology, infrastructure, renewable energy, and manufacturing. This positive trend can be attributed to factors such as improved political stability, a growing consumer market, abundant natural resources, and a young population. Investors considering Africa should conduct thorough research, establish local partnerships, identify growth sectors, and consider long-term objectives. It is recommended to seek guidance from Africa-focused funds or financial institutions with expertise in the region to maximize the potential of this investment renaissance.

Thank you for joining us in exploring the opportunities and trends in African investment! We hope you found this article informative and insightful. Should you have any further questions or require more information, please feel free to reach out to us.

Post a Comment for "Investment Renaissance: Adapting To The Modern Economy"