Investment Horizons: Exploring New Frontiers Of Wealth Creation

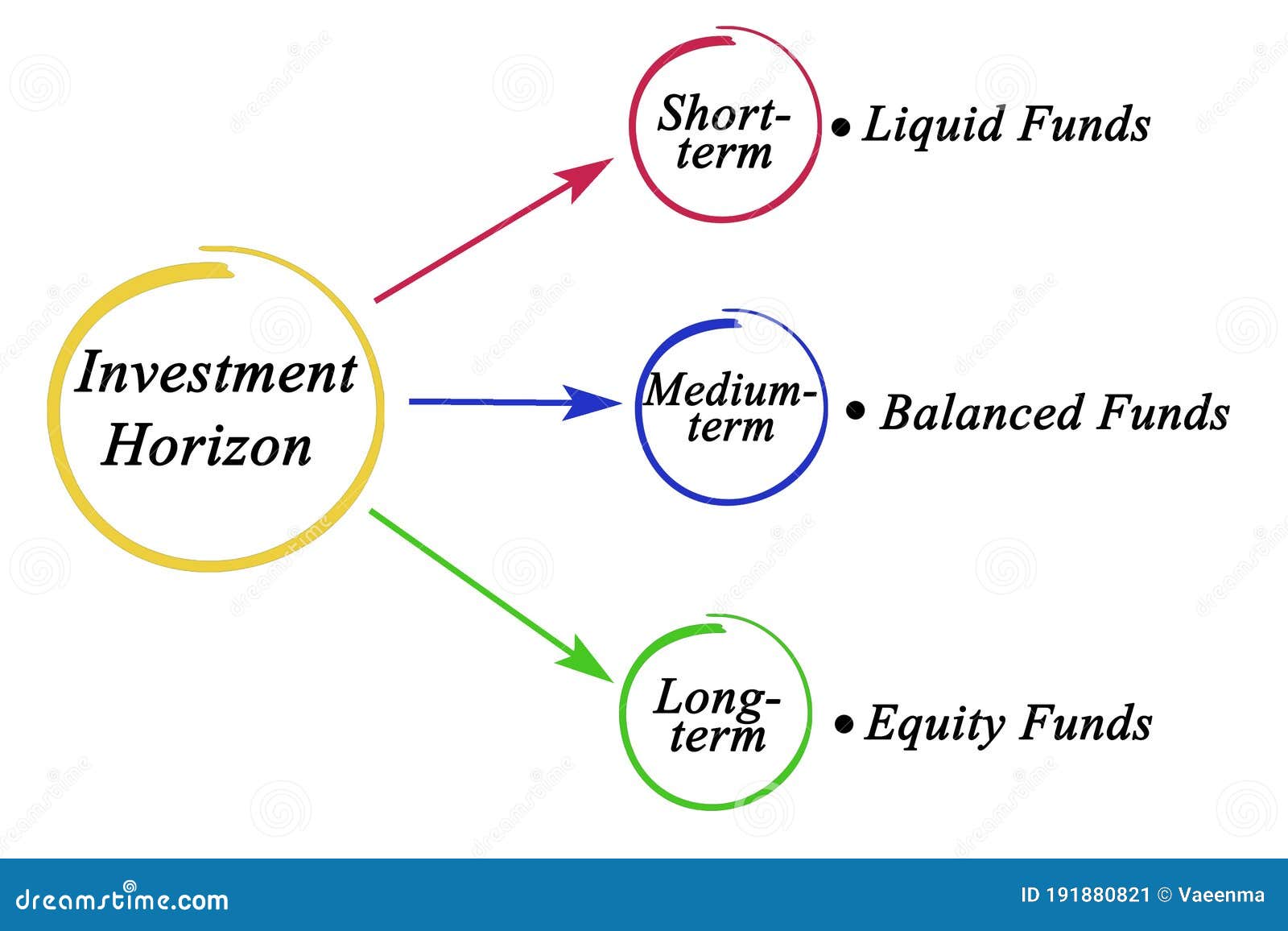

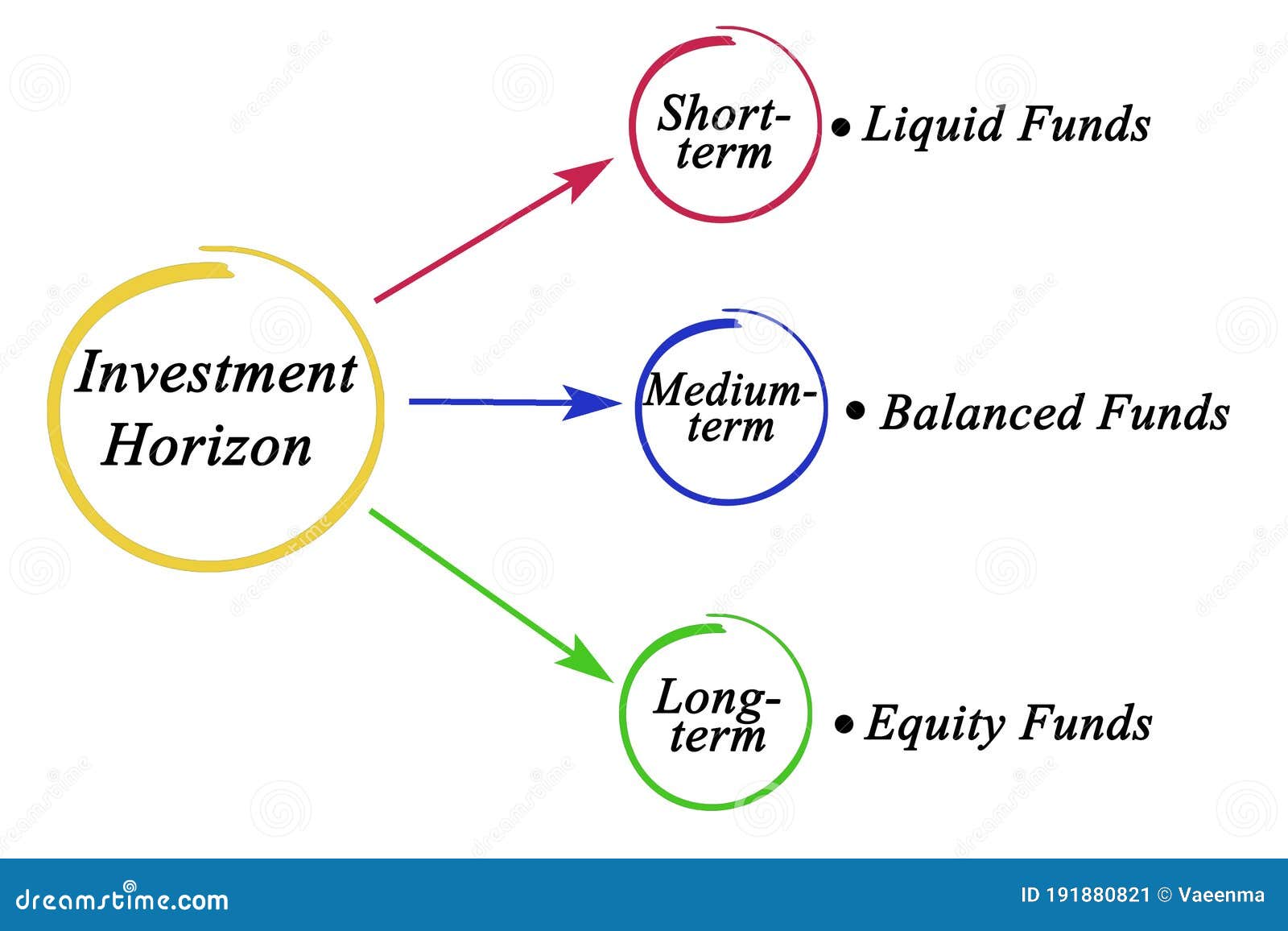

Investment horizon refers to the length of time an investor expects to hold an investment before selling it. It is an essential factor to consider when making investment decisions. Different types of investment horizons exist, each with its own characteristics and potential risks and rewards. In this post, we will explore the various types of investment horizons and provide valuable insights to help you make informed investment decisions.

What is an Investment Horizon?

An investment horizon is the length of time an investor plans to hold an investment before selling it. It determines how long an investor is willing to wait to achieve their financial goals. Investment horizons can vary significantly from person to person and depend on factors such as financial objectives, risk tolerance, and life circumstances.

Understanding your investment horizon is crucial as it helps you select suitable investment options and develop appropriate strategies. Let's delve into the different types of investment horizons and their key features:

Short-Term Investment Horizon

A short-term investment horizon typically ranges from a few months to a year. Investors with a short-term horizon tend to prioritize liquidity and quick returns. They have immediate financial goals, such as saving for a vacation, buying a car, or covering near-future expenses.

Investments suitable for a short-term horizon include:

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts, providing a safe and easily accessible option for short-term goals.

- Certificates of Deposit (CDs): CDs guarantee a fixed interest rate over a specified period. They are low-risk investments ideal for short-term savings objectives.

- Money Market Accounts: These accounts invest in short-term, low-risk securities and provide higher interest rates than regular savings accounts.

Medium-Term Investment Horizon

A medium-term investment horizon typically ranges from one to five years. Investors with a medium-term horizon aim to grow their wealth steadily, balancing risk and returns. They might have goals like saving for a down payment on a house, paying for higher education, or starting a small business.

Suitable investment options for a medium-term horizon include:

- Stocks and Bonds: Diversified portfolios of stocks and bonds can provide potential growth and income over a medium-term timeframe. However, it's essential to carefully research and select stocks and bonds that align with your risk tolerance.

- Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on stock exchanges. They offer diversification and can be a cost-effective way to gain exposure to different market sectors.

- Mutual Funds: Mutual funds pool money from various investors to invest in a diversified portfolio. They provide professional management and are suitable for investors seeking diversification.

Long-Term Investment Horizon

A long-term investment horizon typically extends beyond five years. Investors with a long-term horizon focus on growth and maximizing potential returns over an extended period. They might have objectives like saving for retirement, funding their children's education, or leaving a financial legacy.

Investments suitable for a long-term horizon include:

- Individual Retirement Accounts (IRAs): IRAs offer tax advantages for retirement savings. Contributions made to traditional IRAs are tax-deductible, while earnings grow tax-deferred until withdrawal.

- 401(k) Plans: If offered by your employer, contributing to a 401(k) plan can be an excellent long-term investment strategy. These plans often include an employer match, providing additional funds for retirement.

- Real Estate: Investing in real estate can provide both income and long-term appreciation. Rental properties or real estate investment trusts (REITs) can be beneficial for diversification and wealth accumulation.

Tips for Investment Horizon Planning

When planning your investment horizon, consider the following tips:

- Evaluate Financial Goals: Clearly define your financial goals, including short-term, medium-term, and long-term objectives. This will help you in determining the appropriate investment horizon for each goal.

- Assess Risk Tolerance: Understand your risk tolerance and investment preferences. Determine how comfortable you are with potential fluctuations in investment value and align your investments accordingly.

- Seek Professional Advice: Consulting with a financial advisor can help you navigate the complexities of investment horizon planning. They can provide personalized guidance based on your specific financial situation.

- Diversify: Diversification is an essential strategy to spread your investment risk. Invest in a mix of asset classes, such as stocks, bonds, real estate, and commodities, to enhance potential returns and protect against market volatility.

- Review and Rebalance: Regularly review your investment portfolio to ensure it aligns with your investment horizon and financial goals. Rebalancing may be necessary to maintain the desired asset allocation.

Recommendation for Investment Horizon Selection

Selecting the most appropriate investment horizon is crucial for achieving your financial goals. Here are a few recommendations to guide your decision-making process:

- Consider your Time Horizon: Assess the number of years you have until you need to access the invested funds.

- Define your Financial Goals: Clearly articulate your objectives and quantify the amount of money needed to achieve them.

- Evaluate Risk Tolerance: Understand the amount of investment risk you are comfortable with and how it aligns with your financial goals and potential returns.

- Diversify your Investments: Spread your investments across different assets to mitigate risk and improve potential returns.

- Monitor and Adjust: Regularly review your investment portfolio and make necessary adjustments to stay on track towards your financial goals.

Listicle of the Benefits of Long-Term Investment Horizon

Investing with a long-term horizon offers numerous benefits:

- Compound Interest: Long-term investments have more time to compound, resulting in significant growth over the years. Compound interest allows you to earn returns on your initial investment as well as on the accumulated interest.

- Opportunity to Ride Out Market Volatility: By adopting a long-term perspective, you are more likely to weather short-term market fluctuations. The stock market historically tends to recover from downturns, rewarding patient long-term investors.

- Potential for Higher Returns: Long-term investments have the potential to deliver better returns compared to short-term investments. Over a more extended period, you can tolerate short-term market volatility and capture the full potential of profitable investment opportunities.

- Lower Taxes: Certain long-term investments, such as retirement accounts, may offer tax advantages. Earnings on these investments may be taxed at a lower rate or may grow tax-deferred, potentially reducing your current tax burden.

- Goal Achievement: Long-term investments allow you to work towards significant financial goals, such as retirement or funding your children's education. They provide the time needed to accumulate the necessary funds.

Question & Answer

Q: What if I need to access my funds before my investment horizon is complete?

A: If you have an emergency or unexpected financial need, you may need to access your funds earlier than anticipated. In such cases, having a diversified investment portfolio can be beneficial. Short-term investments or more liquid options can be utilized to fulfill your immediate financial requirements.

Q: Is it possible to change my investment horizon?

A: Yes, it is possible to change your investment horizon. As life circumstances change, financial goals may evolve, requiring adjustments to your investment strategy. However, consistently changing investment horizons can lead to suboptimal returns and increased transaction costs. It is essential to carefully evaluate and plan any changes to your investment horizon.

Q: Can I have multiple investment horizons simultaneously?

A: Yes, it is common to have multiple investment horizons simultaneously. As an investor, you may have short-term goals, such as saving for a vacation, as well as long-term goals, like retirement planning. Diversifying your investment portfolio across different horizons can help you meet these distinct objectives effectively.

Summary

Determining the appropriate investment horizon is crucial for achieving your financial goals. Short-term horizons are suited for immediate financial objectives and prioritize liquidity, while medium-term horizons aim for steady growth. Long-term horizons focus on maximizing returns over an extended period. By considering your financial goals, risk tolerance, and time horizon, you can select the most suitable investment horizon. Remember to diversify your investments, seek professional advice, and regularly review and adjust your portfolio to stay on track towards achieving your financial aspirations.

Investing requires careful consideration and an understanding of your unique circumstances. Whether you are investing for the long-term or seeking short-term gains, it is essential to research and select investment options that align with your financial goals. Plan wisely, stay informed, and enjoy the journey towards financial success!

Post a Comment for "Investment Horizons: Exploring New Frontiers Of Wealth Creation"