Investment Horizons: Expanding Your Wealth Frontiers

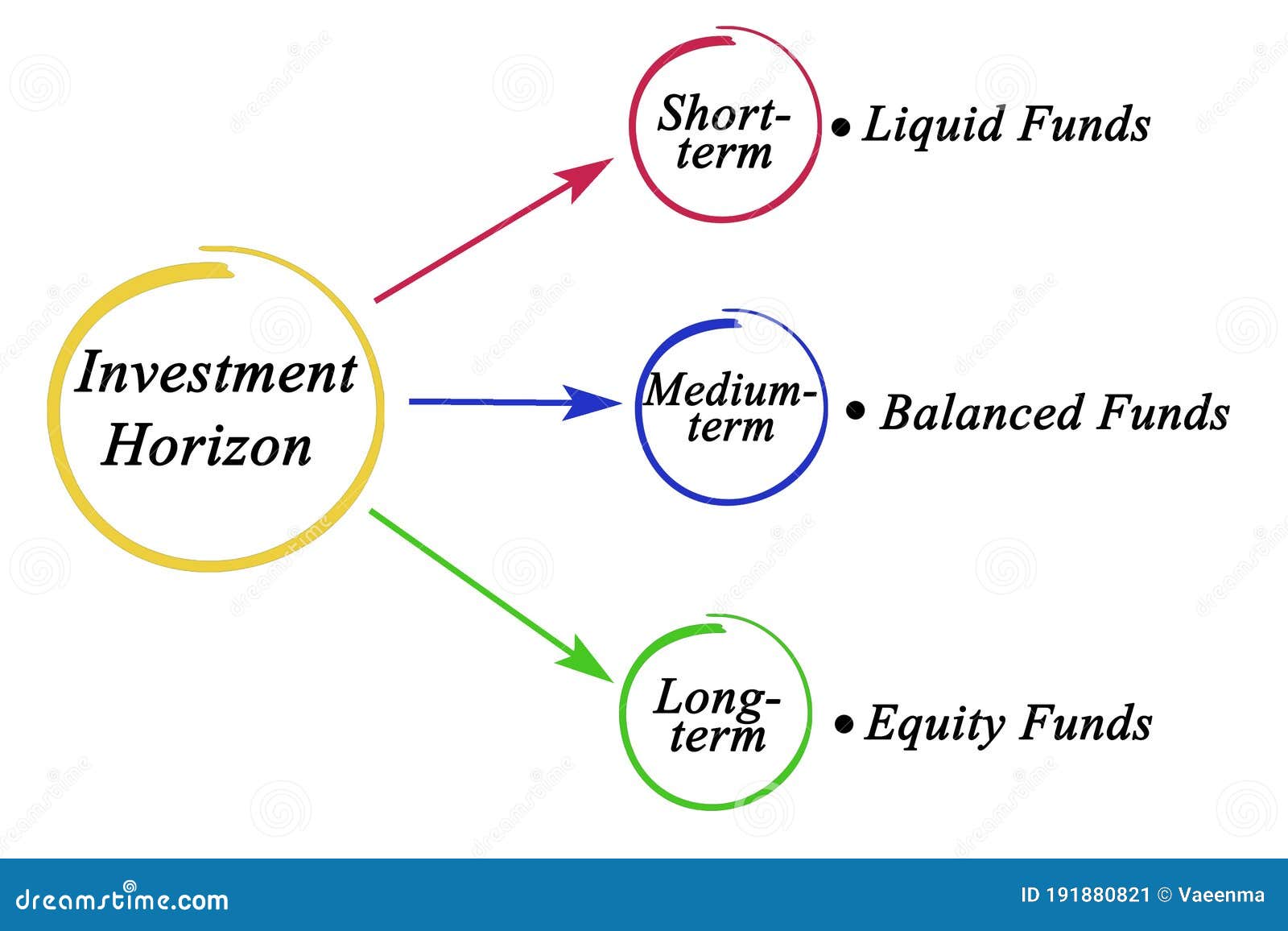

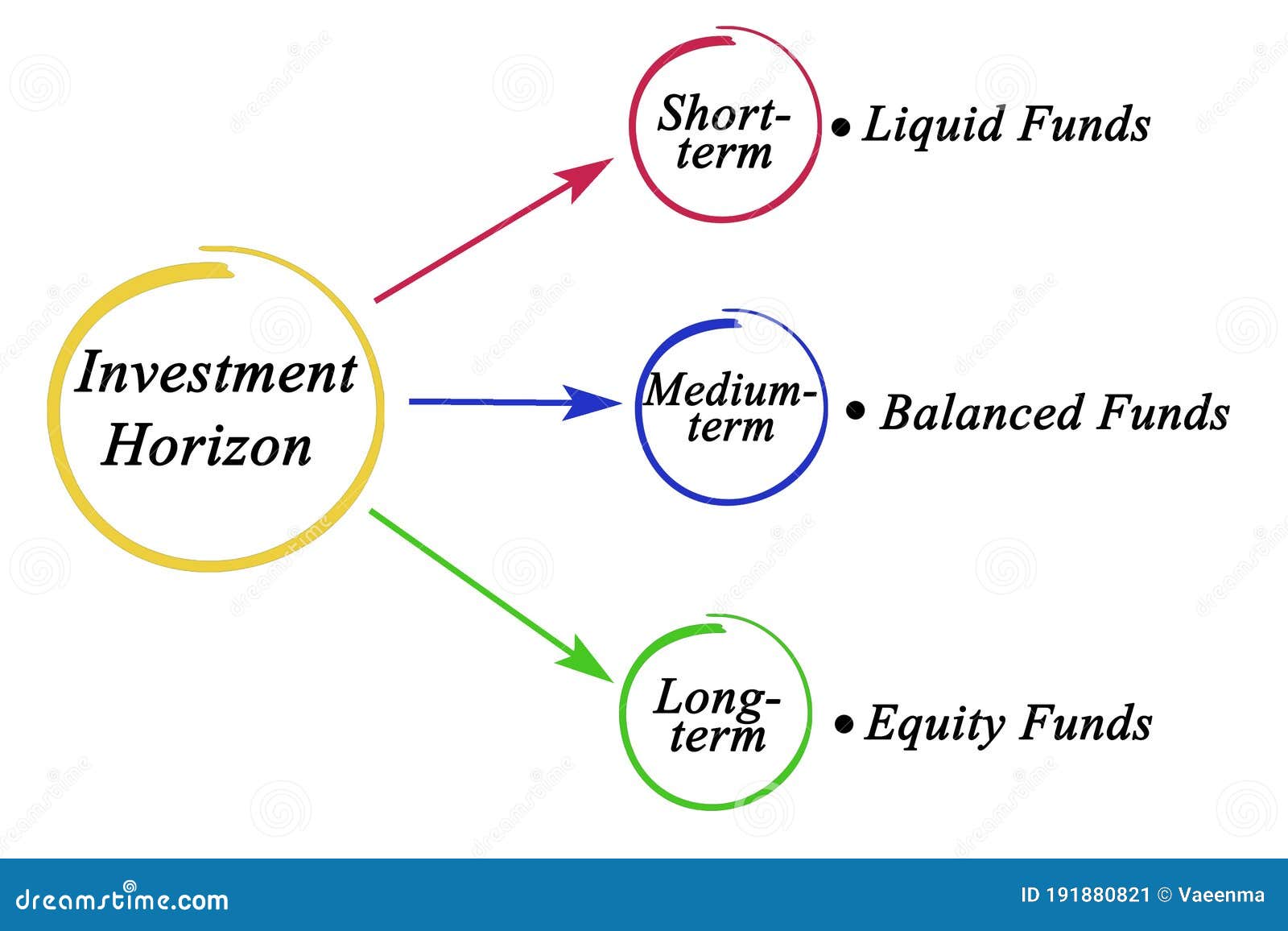

When it comes to investing, understanding the different types of investment horizons is crucial. The investment horizon refers to the length of time an investor is willing to hold onto an investment before needing the funds back.

There are three primary types of investment horizons: short-term, medium-term, and long-term. Each type has its own characteristics, risk levels, and potential returns. In this post, we will delve deeper into each type of investment horizon, providing tips, recommendations, and essential information to help you make informed investment decisions.

What is Short-Term Investment Horizon?

Short-term investment horizon refers to a period ranging from a few weeks to a couple of years. This type of investment is suitable for individuals with immediate financial goals, such as buying a car, saving for a vacation, or covering emergency expenses. Short-term investments typically offer lower returns but also come with reduced risk compared to medium and long-term investments.

When considering short-term investments, it is essential to prioritize liquidity. Liquidity refers to the ease with which an investment can be converted into cash without incurring significant losses. Common examples of short-term investments include certificates of deposit (CDs), money market accounts, and Treasury bills.

While short-term investments offer the advantage of quick access to funds, they may not be ideal for long-term financial growth. It is advisable to have a well-diversified portfolio that includes a mix of both short and long-term investments to cater to different financial needs.

Tips For Short-Term Investment Horizon

1. Choose low-risk investments: Since the time frame for short-term investments is relatively short, it is crucial to prioritize capital preservation. Opt for low-risk investments, such as government bonds or high-rated corporate bonds.

2. Consider money market funds: Money market funds are mutual funds that invest in high-quality, short-term debt securities. They are a popular choice for short-term investors due to their low risk and stable returns.

3. Be mindful of inflation: Short-term investments are susceptible to inflation risk. Make sure to factor in inflation and choose investments that provide a return higher than the inflation rate to maintain your purchasing power.

4. Set realistic goals: Define your short-term financial goals clearly. This will help you determine the required investment amount and the appropriate investment vehicles to achieve your goals.

5. Regularly reassess your investments: Keep a close eye on your short-term investments and reassess their performance periodically. If a particular investment is consistently underperforming, it may be wise to divest and explore other options.

By following these tips, you can make informed decisions and maximize the returns on your short-term investments while minimizing the associated risks.

What is Medium-Term Investment Horizon?

Medium-term investment horizon refers to a period ranging from a few years to a decade. It is well-suited for individuals looking to achieve specific goals within a moderate time frame, such as saving for a down payment on a house or funding a child's education.

The risk and returns associated with medium-term investments fall between short-term and long-term investments. Investors have the potential to earn higher returns compared to short-term investments, but they also face higher risks.

Suitable investment options for medium-term investment horizons include a mix of fixed-income securities, dividend-paying stocks, and balanced mutual funds. The diversified nature of these investment vehicles helps mitigate risks and provide steady growth over time.

Tips For Medium-Term Investment Horizon

1. Diversify your portfolio: Spread your investments across various asset classes, such as stocks, bonds, and real estate. Diversification helps minimize the impact of market fluctuations and enhance the potential for returns.

2. Consider tax implications: Depending on your country's tax regulations, certain investments may offer tax benefits. Consult with a financial advisor or tax professional to make informed decisions and optimize your tax efficiency.

3. Define your risk tolerance: Assess your risk tolerance level and align it with your investment choices. While medium-term investments carry higher risk than short-term investments, it is crucial to strike a balance between risk and potential returns based on your risk appetite.

4. Regularly review your investment strategy: Economic conditions and market dynamics can change over time. Periodically review your investment strategy to ensure it aligns with your goals, and modify it if necessary.

5. Stay informed: Keep yourself updated with market trends and developments. Subscribe to reputable financial publications, follow trusted investment blogs, and seek advice from professionals to make well-informed investment decisions.

By following these tips, you can navigate the medium-term investment horizon effectively and make investments that align with your financial goals.

What is Long-Term Investment Horizon?

Long-term investment horizon refers to an extended period, typically exceeding a decade or more. Long-term investments are suitable for individuals looking to build wealth over time, save for retirement, or create a financial legacy for future generations.

Long-term investments offer the potential for higher returns but also entail higher market volatility and risk. They are typically more focused on growth-oriented assets like stocks and real estate but can also include fixed-income securities and other investment vehicles.

Investing for the long term requires patience and a disciplined approach. The goal is to capitalize on compound interest and ride out market fluctuations to achieve substantial wealth accumulation over time.

Tips For Long-Term Investment Horizon

1. Start early: Time is a valuable asset when it comes to long-term investing. The sooner you start investing, the longer your money has to grow and benefit from compounding returns.

2. Embrace a diversified approach: Diversification is key to managing risk in long-term investments. Invest in a mix of asset classes, such as stocks, bonds, real estate, and commodities, to ensure your portfolio is well-balanced.

3. Maintain a long-term perspective: Long-term investing requires the ability to ride out short-term market volatility. Avoid making impulsive decisions based on short-term movements and stay focused on your long-term financial goals.

4. Consider professional advice: If you are unsure about managing your long-term investment portfolio, consider seeking advice from a financial advisor or investment professional. They can help create a comprehensive investment plan aligned with your risk tolerance and long-term goals.

5. Periodic portfolio review: While long-term investments require a patient approach, it is still essential to review your investment portfolio periodically. Make necessary adjustments based on changes in market conditions, your financial goals, or personal circumstances.

By following these tips, you can build a robust long-term investment strategy that aligns with your financial aspirations and sets you on the path to financial freedom.

Recommendation: Blend of Short, Medium, and Long-Term Investments

While understanding each type of investment horizon is crucial, it is equally important to strike a balance between short-term, medium-term, and long-term investments. Diversifying your portfolio across different investment horizons can help mitigate risks and optimize returns.

A well-balanced investment portfolio typically includes a mix of low-risk short-term investments for immediate financial needs, medium-term investments for specific goals in the near future, and long-term investments for long-term financial growth.

By combining different investment horizons, you can take advantage of the unique benefits offered by each type and create a holistic investment strategy.

Listicle of Popular Investment Strategies for Different Horizons

1. Short-term investment strategies:

- Day trading in stocks

- Investing in low-duration bond funds

- Trading cryptocurrencies

2. Medium-term investment strategies:

- Investing in dividend-paying stocks

- Allocating funds to balanced mutual funds

- Participating in real estate investment trusts (REITs)

3. Long-term investment strategies:

- Investing in index funds for broad market exposure

- Building a diversified stock portfolio

- Investing in exchange-traded funds (ETFs)

This listicle showcases some popular investment strategies for different investment horizons. However, it is essential to conduct thorough research and evaluate each strategy's suitability based on your risk profile, financial goals, and time frame.

Question & Answer: Common Queries about Investment Horizons

Q: What if my investment horizon changes?

A: It is common for investment horizons to change based on evolving financial goals or personal circumstances. If your investment horizon changes, adapt your investment strategy accordingly. Consult with a financial advisor to ensure your investments align with your revised investment horizon.

Q: Are there any risks involved in long-term investing?

A: Yes, investing in the long term does come with risks, including market volatility, economic downturns, and the risk of individual company performance. However, historically, the stock market has delivered positive returns over the long term, making it an attractive avenue for wealth accumulation.

Q: Can I have a mix of different investment horizons within the same investment account?

A: Yes, most investment accounts allow you to have a mix of short-term, medium-term, and long-term investments. Diversifying your investments across different horizons in a single account can help manage your overall portfolio effectively.

Q: How often should I review my investment portfolio?

A: The frequency of portfolio reviews depends on individual preferences and market conditions. However, it is generally advisable to conduct a thorough review at least once a year or when significant life or financial events occur.

Q: What if I need to access my funds before my investment horizon ends?

A: If you need to access your funds before your investment horizon ends, you may have to sell your investments prematurely. However, depending on market conditions, this may result in losses or missed investment opportunities. It is essential to plan your investments with your financial goals and liquidity requirements in mind.

Summary

Understanding the different types of investment horizons is fundamental to successful financial planning. Short-term investments offer liquidity and lower risk, making them suitable for immediate financial needs. Medium-term investments strike a balance between risk and returns, catering to specific goals within a moderate time frame. Long-term investments focus on growth-oriented assets and are ideal for long-term wealth accumulation.

By diversifying your investment portfolio across different horizons and following the tips and recommendations shared in this post, you can make informed investment decisions aligned with your financial goals. Remember to regularly review your investments, stay updated on market trends, and consult with professionals when needed to optimize your investment strategy.

Note: The information provided in this article is for educational purposes only and does not constitute financial advice. Invest wisely and consider your personal circumstances and risk tolerance before making investment decisions.

Post a Comment for "Investment Horizons: Expanding Your Wealth Frontiers"