Investment Horizons: Exploring New Frontiers Of Profit

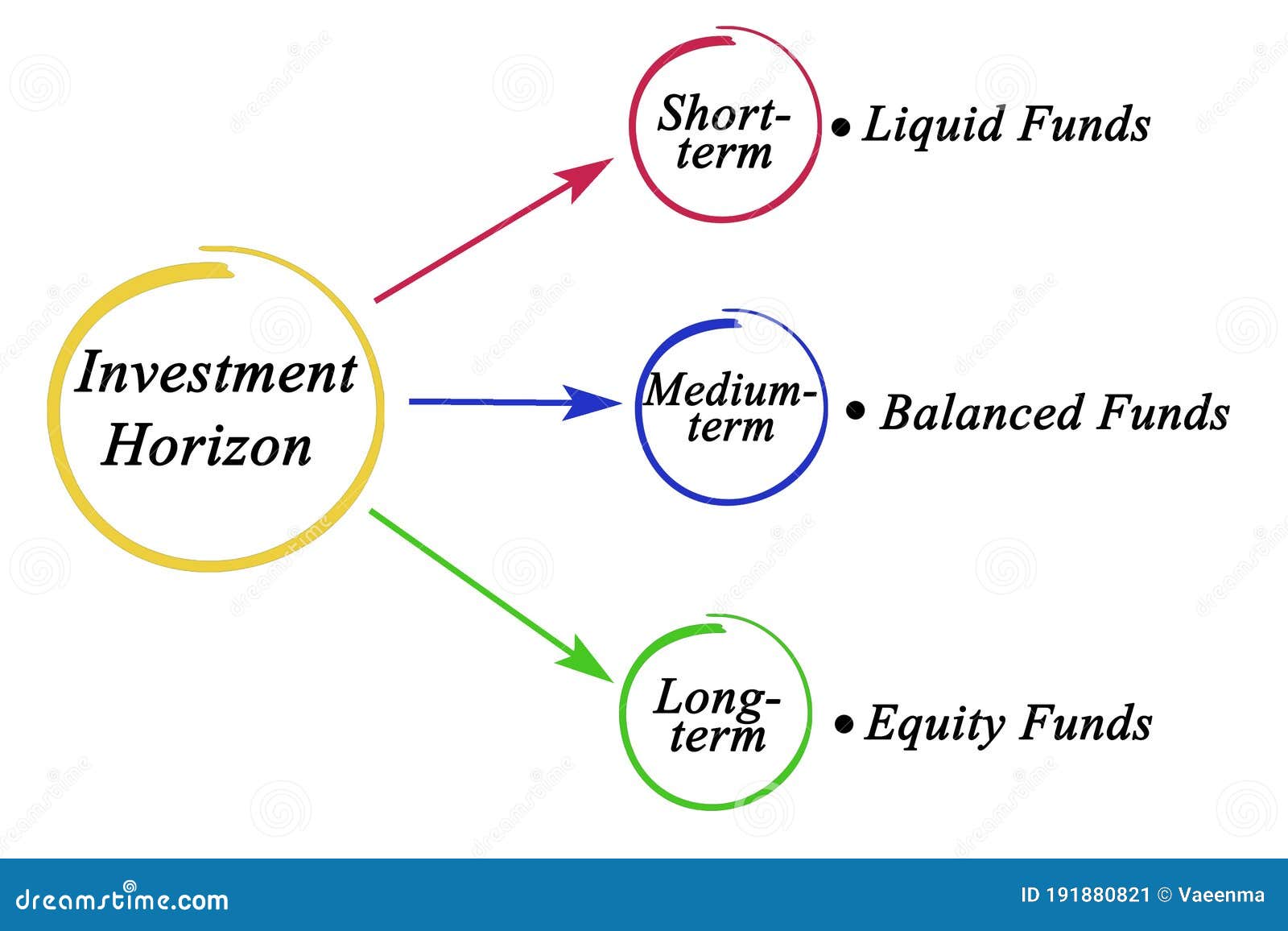

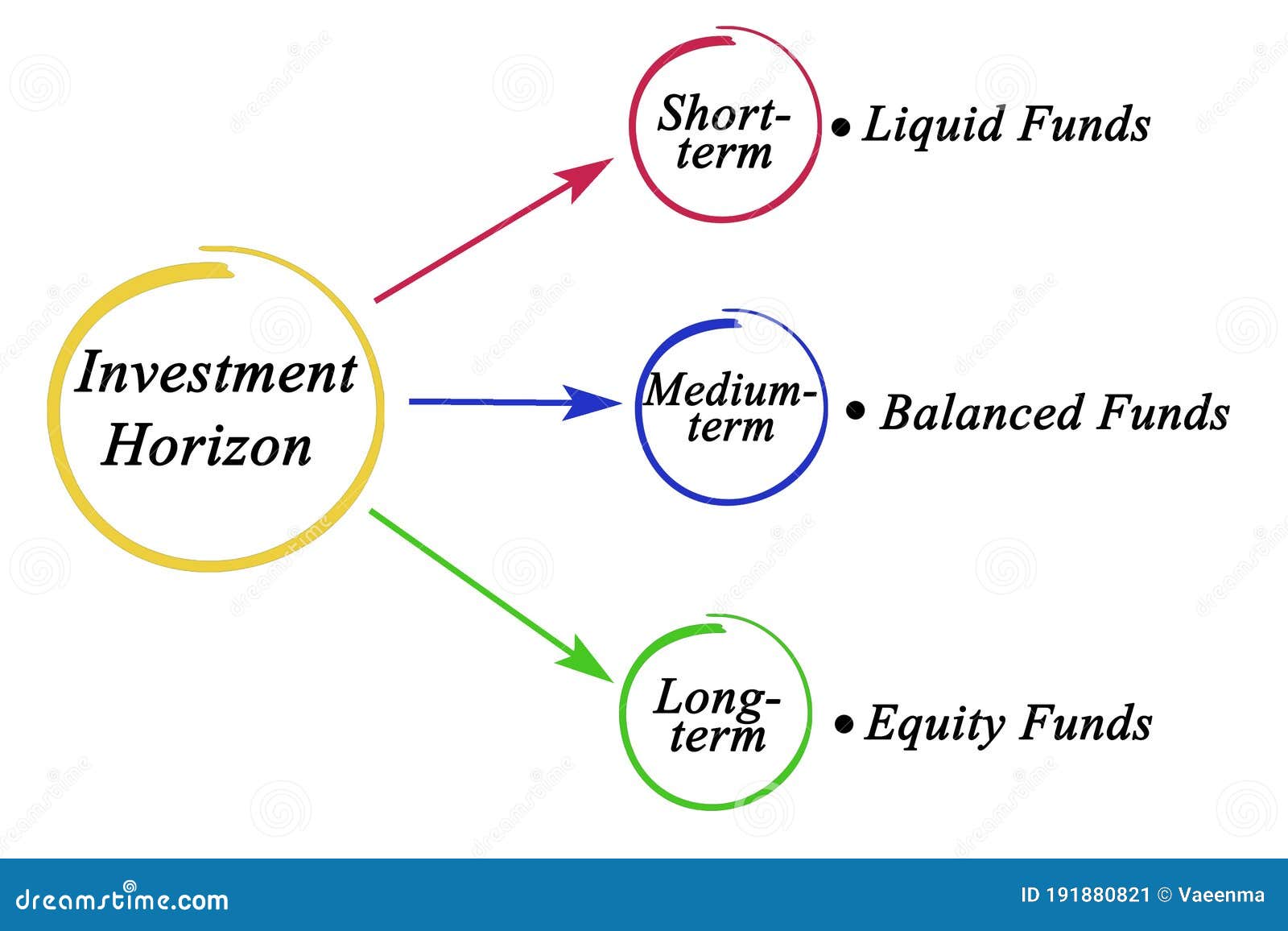

Investment horizon refers to the length of time an individual plans to hold on to an investment before needing to access the funds. It is an important concept in the world of finance and can greatly impact the strategies and choices investors make. Understanding the different types of investment horizon is crucial for anyone looking to make smart investment decisions. In this article, we will dive deep into this topic and explore the various types of investment horizon that exist.

1. Short-term Investment Horizon:

A short-term investment horizon typically refers to a time frame of one year or less. Investors with a short-term horizon are usually looking to make quick profits and are willing to take on higher levels of risk. Common examples of short-term investments include day trading in the stock market, investing in high-yield savings accounts, or buying and selling cryptocurrencies.

2. Medium-term Investment Horizon:

A medium-term investment horizon usually falls between one to five years. Investors with a medium-term horizon have a slightly longer time frame and are willing to take on moderate levels of risk. They may invest in assets such as bonds, mutual funds, or real estate. These investments offer better potential returns compared to short-term options, but still maintain a level of liquidity.

3. Long-term Investment Horizon:

A long-term investment horizon typically extends beyond five years. Investors with a long-term horizon are often focused on building wealth over an extended period and are willing to tolerate higher market fluctuations. Common examples of long-term investments include retirement accounts, stocks, or index funds. These investments aim for growth and provide potential higher returns due to compounding over time.

4. What is the Importance of Investment Horizon?

The investment horizon is a crucial factor to consider when creating an investment strategy. It helps investors determine the appropriate asset allocation and risk tolerance. Understanding your investment horizon allows you to choose investments that align with your goals and time frame. Different investment horizons require different approaches and can greatly impact the potential returns and risk exposure.

5. Tips For Identifying Your Investment Horizon:

Identifying your investment horizon is the first step towards building a successful investment portfolio. Here are some tips to help you determine your investment horizon:

- Consider your financial goals: Are you saving for a short-term expense, such as a vacation, or a long-term goal like retirement?

- Evaluate your risk tolerance: How comfortable are you with taking on investment risks?

- Analyze your time frame: When will you need to access the funds? Is it in the next few years or a decade from now?

- Consult a financial advisor: Seeking professional advice can help you better understand your investment horizon and make informed decisions.

6. Recommendations Based on Investment Horizon:

Based on your investment horizon, here are some recommendations to consider:

Short-term Investment Horizon:

If you have a short-term investment horizon, focus on investments that offer quick liquidity and the potential for short-term gains. Consider high-yield savings accounts, money market funds, or short-term bond funds. These options provide relatively low risk and easy access to your funds.

Medium-term Investment Horizon:

If your investment horizon is medium-term, diversify your portfolio by adding a mix of stocks, bonds, and real estate. Choose investments that offer growth potential and reasonable levels of risk. Consider dividend-paying stocks, corporate bonds, or real estate investment trusts (REITs).

Long-term Investment Horizon:

For a long-term investment horizon, focus on long-term growth and capital appreciation. Allocate a higher percentage of your portfolio to equities, such as stock index funds or exchange-traded funds (ETFs). Consider investing in a tax-advantaged retirement account like a 401(k) or an individual retirement account (IRA).

7. Listicle of Investment Strategies for Different Horizons:

- Short-term Investment Horizon:

- Medium-term Investment Horizon:

- Long-term Investment Horizon:

- Day trading in the stock market for quick profits

- Investing in high-yield savings accounts for short-term gains

- Buying and selling cryptocurrencies with the aim of making quick returns

- Investing in bonds or bond funds that offer moderate returns

- Purchasing rental properties for income generation

- Investing in mutual funds with a balanced portfolio of stocks and bonds

- Contributing to retirement accounts and taking advantage of employer matching

- Investing in growth stocks and holding them for extended periods

- Allocating a portion of the portfolio to index funds or ETFs for broad market exposure

8. Frequently Asked Questions About Investment Horizon:

Q: How can I determine my investment horizon?

A: To determine your investment horizon, consider your financial goals, risk tolerance, and time frame. Understanding these factors will help you choose appropriate investments.

Q: Can investment horizon change over time?

A: Yes, investment horizon can change due to various factors such as changes in financial goals, risk tolerance, or life events. It is important to reassess your investment horizon periodically.

Q: What happens if I need to access my investments before my designated horizon?

A: If you need to access your investments before your designated horizon, you may have to sell your investments at a loss or not achieve the desired returns. It is important to plan your investments according to your time frame.

Q: Should I align my investment horizon with my financial goals?

A: Yes, aligning your investment horizon with your financial goals is important. Short-term goals require more conservative investment options, while long-term goals can tolerate more market fluctuations.

9. Summary:

Investment horizon is a critical element to consider when making investment decisions. By identifying your investment horizon, you can create a well-directed investment strategy that aligns with your goals and risk tolerance. Whether you have a short-term, medium-term, or long-term investment horizon, there are suitable investment options available. Remember to always evaluate your investments periodically and make adjustments as necessary to ensure you stay on track towards achieving your financial goals.

Post a Comment for "Investment Horizons: Exploring New Frontiers Of Profit"