Investment Horizons: Expanding Your Wealth Potential

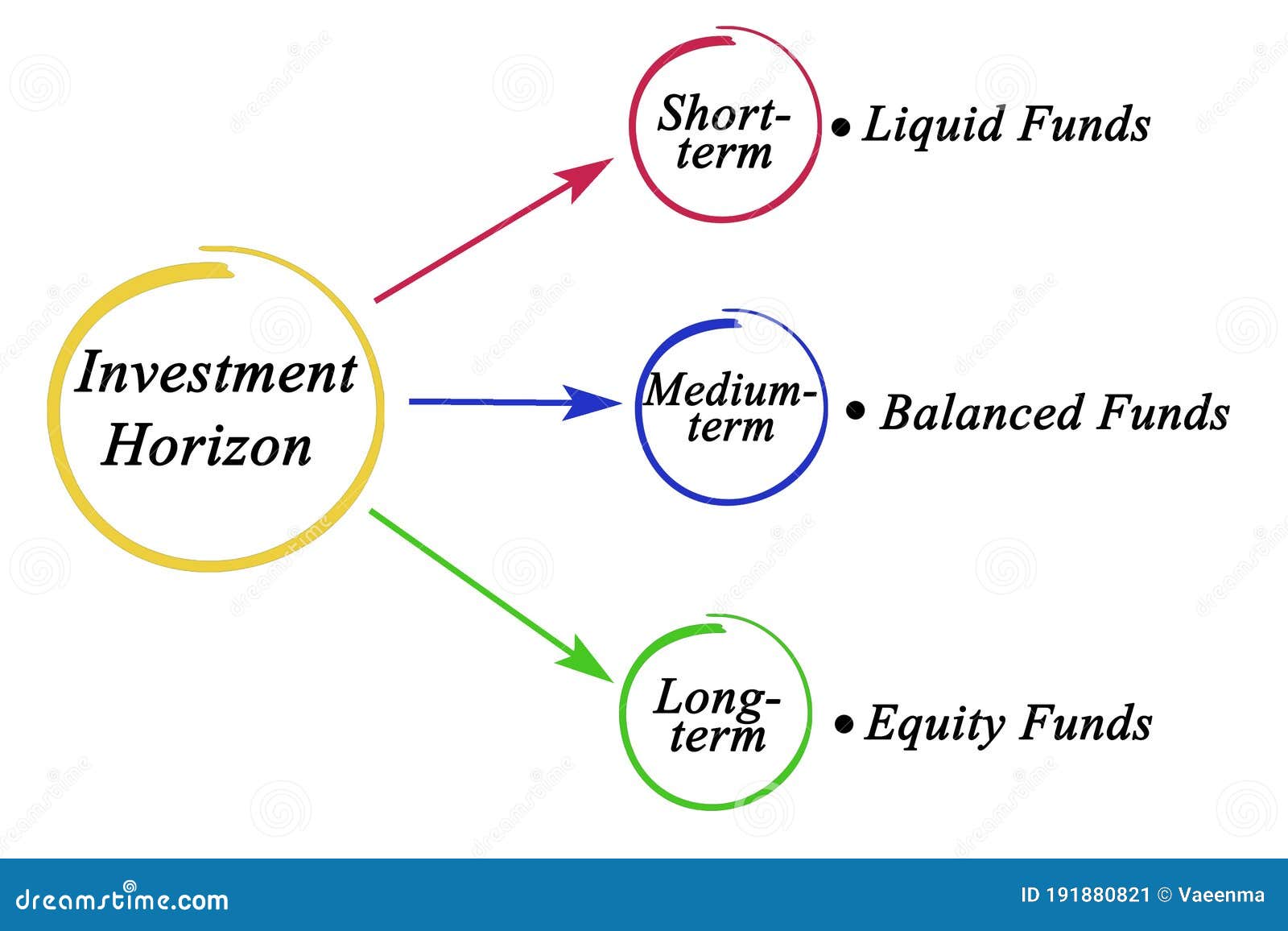

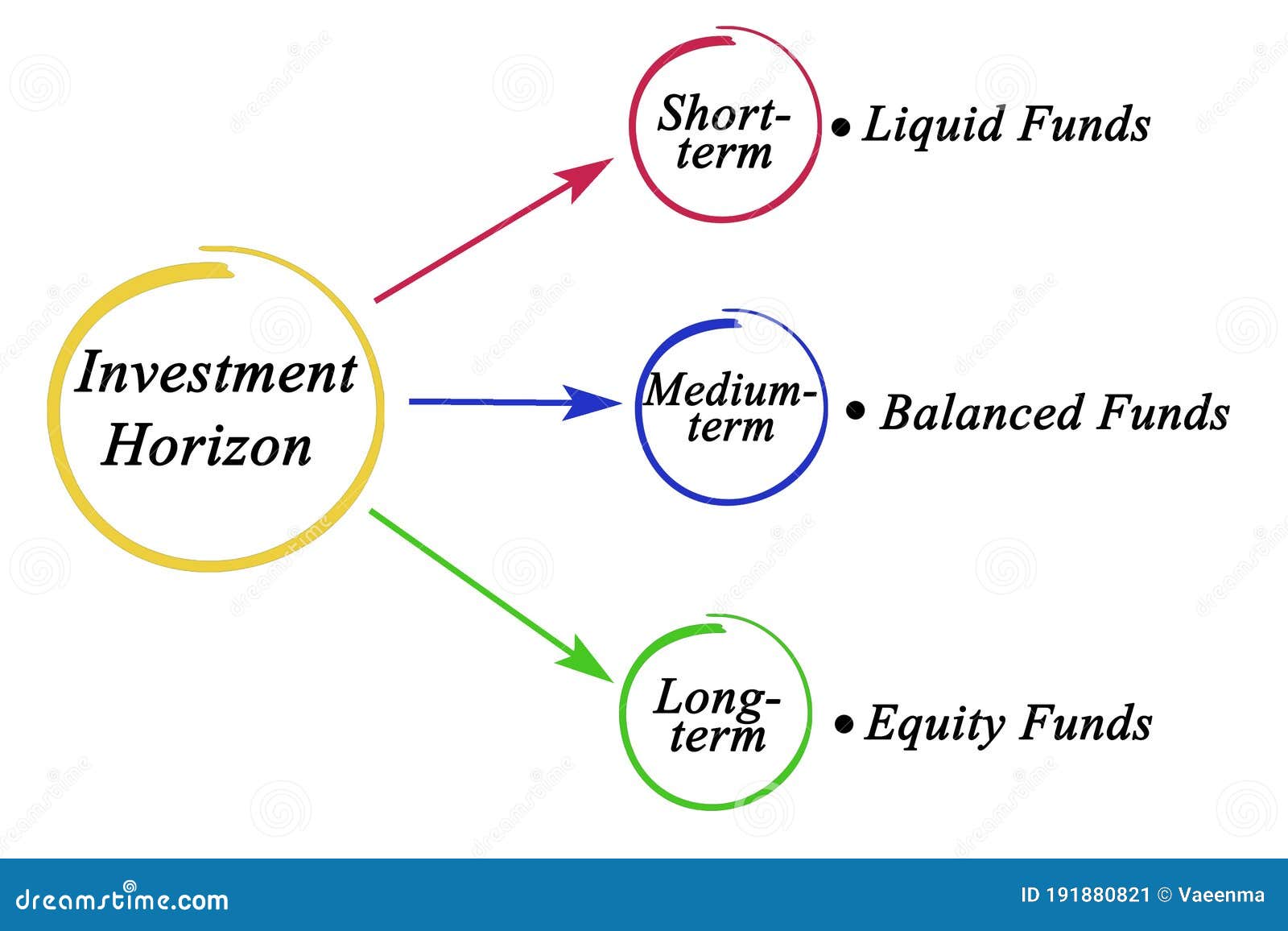

Investment horizon refers to the duration of time an investor is willing to hold onto their investment before needing to access their funds. Understanding the different types of investment horizons can help individuals make informed decisions about their financial goals and strategies.

The image above depicts the three main types of investment horizons: short-term, medium-term, and long-term. Each of these horizons has its own distinct characteristics and may be suited to different investment objectives.

What is an Investment Horizon?

An investment horizon is the length of time over which an investor expects to hold onto a particular investment before needing to sell it or access the funds. It is an important consideration for investors as it can influence the types of investments they choose and the potential returns they can expect.

The investment horizon is closely tied to an individual's financial goals. For example, someone investing for retirement may have a longer investment horizon compared to someone saving for a down payment on a house in the near future.

Tips For Determining Your Investment Horizon

Determining your investment horizon requires careful consideration of various factors. Here are a few tips to help you determine the most appropriate investment horizon for your financial goals:

- Evaluate your financial goals: Consider what you are investing for – is it a short-term goal, such as buying a car, or a long-term goal, such as saving for retirement?

- Assess your risk tolerance: Your risk tolerance plays a crucial role in determining your investment horizon. If you have a lower risk tolerance, you may prefer shorter-term investments with less volatility. On the other hand, if you can tolerate higher levels of risk, you might be more inclined towards long-term investments with potentially higher returns.

- Consider your time horizon: Your investment horizon should align with your time horizon. If you have a longer time horizon, you have more flexibility to weather short-term market fluctuations.

- Seek professional advice: If you are unsure about determining your investment horizon, it is advisable to seek guidance from a financial advisor who can provide personalized recommendations based on your financial situation and goals.

Recommendations for Different Investment Horizons

Investors with different investment horizons may benefit from considering various investment strategies. Here are some recommendations for different types of investment horizons:

Short-Term Investment Horizon:

For individuals with a short-term investment horizon (typically shorter than one year), it is generally advisable to focus on investments that prioritize capital preservation and liquidity. Examples of suitable investments include high-yield savings accounts, money market funds, and short-term certificates of deposit (CDs).

Short-term investments aim to minimize the risk of losing principal and offer the flexibility to access funds when needed. However, the potential returns from these investments may be relatively low compared to long-term investments.

Medium-Term Investment Horizon:

A medium-term investment horizon typically ranges from one to five years. Investors with this horizon may consider a combination of growth-oriented investments and income-generating assets. The objective is to strike a balance between potential returns and risk management.

Some suitable investments for a medium-term horizon include bonds, dividend-paying stocks, mutual funds, and exchange-traded funds (ETFs). These investments have the potential to generate moderate returns while managing risk through diversification.

Long-Term Investment Horizon:

Investors with a long-term investment horizon, typically more than five years, have a greater ability to tolerate market volatility and can aim for higher potential returns. Long-term investments often involve exposure to equities and growth-oriented assets.

Stocks, real estate, index funds, and retirement accounts such as 401(k)s and IRAs are commonly recommended for long-term investment horizons. These investments have historically shown higher returns over extended periods, although they may also experience greater short-term fluctuations.

Key Considerations for Each Investment Horizon

While the recommendations above provide a general guideline, it is important to consider additional factors for each investment horizon. Here are some key considerations:

Short-Term Investment Horizon:

- Focus on capital preservation and liquidity.

- Keep emergency funds readily accessible.

- Be mindful of potentially lower returns.

Medium-Term Investment Horizon:

- Balance between growth and income-generating assets.

- Consider diversification to manage risk.

- Review investments periodically to ensure alignment with financial goals.

Long-Term Investment Horizon:

- Have a higher tolerance for volatility.

- Consider a diversified portfolio with exposure to different asset classes.

- Review and rebalance investments regularly.

Listicle of Investment Horizon Strategies

To further explore the different investment horizons, let's take a look at a listicle outlining strategies for each horizon:

Short-Term Investment Horizon Strategies:

- Invest in high-yield savings accounts or money market funds.

- Consider short-term certificates of deposit (CDs).

- Explore Treasury bills or short-term government bonds.

Medium-Term Investment Horizon Strategies:

- Allocate funds to a diversified mix of bonds and stocks.

- Consider investing in dividend-paying stocks.

- Explore mutual funds or ETFs that align with your investment objectives.

Long-Term Investment Horizon Strategies:

- Invest in low-cost index funds for broad market exposure.

- Consider long-term growth stocks for potential capital appreciation.

- Maximize contributions to retirement accounts such as 401(k)s or IRAs.

Question & Answer

Q: Can my investment horizon change over time?

A: Yes, your investment horizon can change throughout your life. As your financial goals evolve or unexpected circumstances arise, you may need to reassess your investment horizon and adjust your investment strategy accordingly.

Q: Is it possible to have multiple investment horizons?

A: Yes, some individuals may have multiple investment horizons. For example, you may be saving for a short-term expense while also investing for retirement, each with its own distinct investment horizon and strategy.

Q: How often should I review my investment horizon?

A: It is generally recommended to periodically review your investment horizon, especially when major life events occur or when your financial goals or risk tolerance change. Consulting with a financial advisor can help ensure your investment horizon remains aligned with your objectives.

Summary

Determining the right investment horizon is crucial for achieving your financial goals and managing your investments effectively. Short-term, medium-term, and long-term investment horizons each offer distinct investment strategies and require consideration of factors such as goals, risk tolerance, and time horizon.

Remember to evaluate your financial goals, assess your risk tolerance, and seek professional advice when needed. By understanding the various investment horizons and tailoring your investment strategy accordingly, you can work towards building a brighter financial future.

Post a Comment for "Investment Horizons: Expanding Your Wealth Potential"