Investment Horizons: Discovering New Frontiers Of Wealth

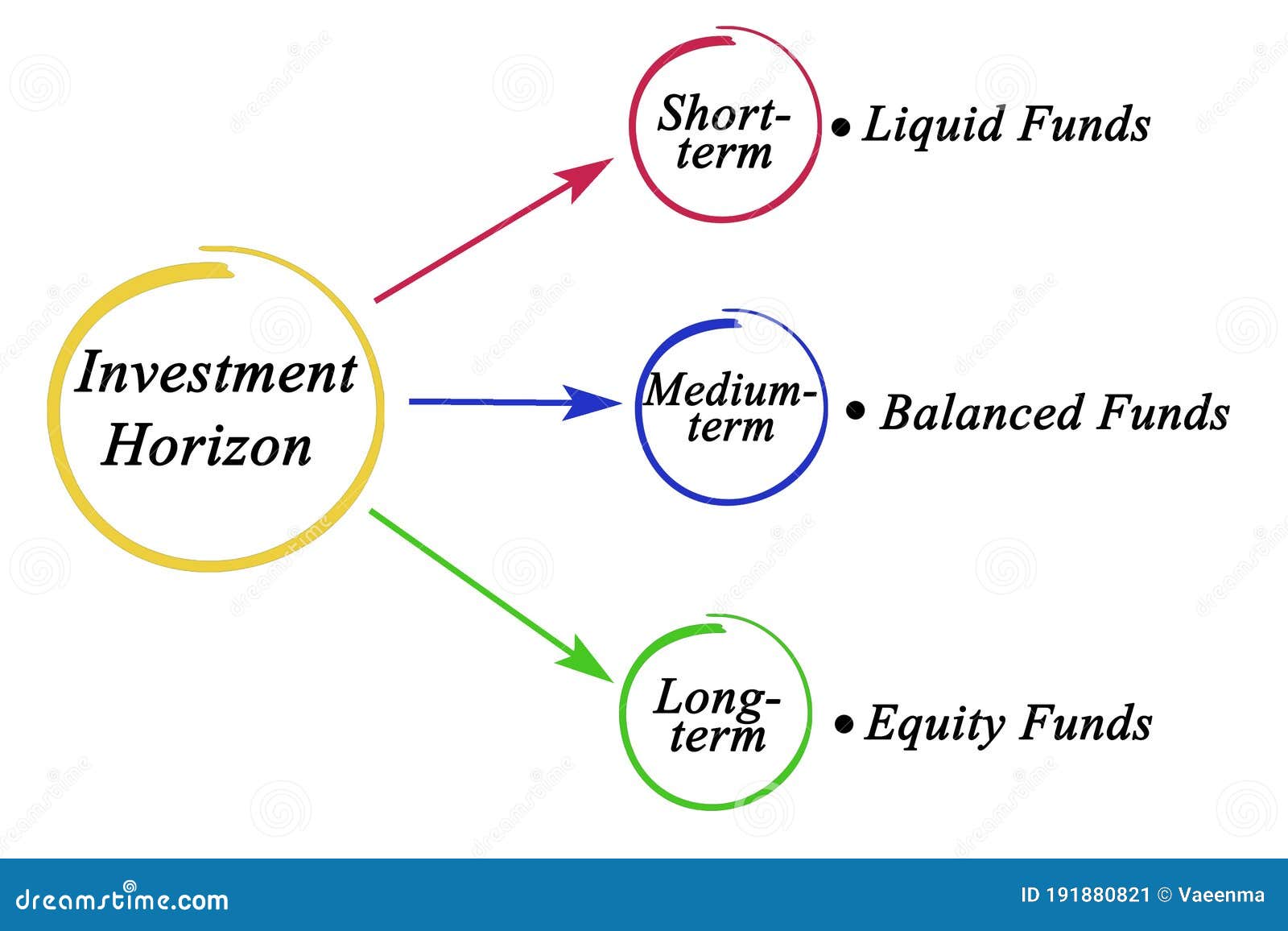

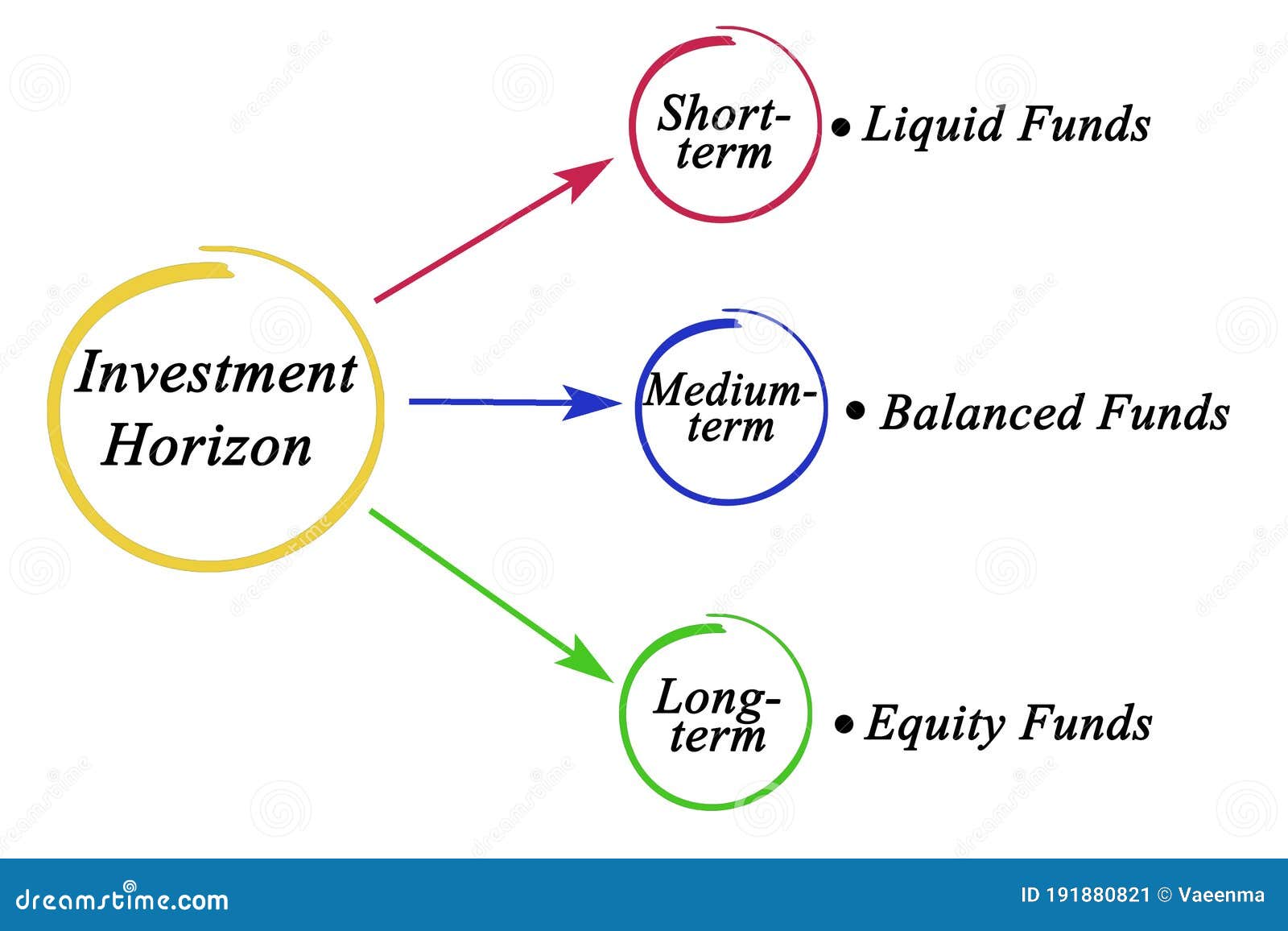

An investment horizon refers to the length of time an investor intends to hold an investment before selling it. It is an important factor to consider when making investment decisions, as it affects the level of risk one is willing to take and the potential returns they expect. There are different types of investment horizons, each with its own characteristics and considerations.

Long-term investment horizon:

A long-term investment horizon typically spans over several years, often 10 years or more. Investors with a long-term perspective are willing to ride out short-term market fluctuations and focus on the potential growth of their investments over time. This approach allows them to take advantage of compound interest and benefit from the power of compounding.

One advantage of a long-term investment horizon is the ability to invest in assets with higher volatility but potentially higher returns, such as stocks. Stocks have historically generated higher returns compared to other asset classes over the long term, although they can be subject to significant short-term volatility. By maintaining a long-term perspective, investors can stay invested in stocks and potentially benefit from their growth.

Additionally, a long-term investment horizon provides investors with time to recover from market downturns. Over the long term, the impact of short-term fluctuations tends to smooth out, and investments have historically demonstrated an upward trajectory.

Medium-term investment horizon:

A medium-term investment horizon typically ranges from one to five years. Investors with a medium-term perspective have a balance between risk and return, as they are willing to tolerate some level of volatility but also have a specific timeframe for their investment goals.

One common medium-term investment is bonds. Bonds are debt securities that provide fixed income to investors. They are considered less risky than stocks and can be an attractive option for investors with a shorter investment horizon. Bonds generally offer regular interest payments and return the principal amount at maturity, providing a predictable income stream.

Another investment strategy for medium-term horizons is a diversified portfolio. By spreading investments across different asset classes, such as stocks, bonds, and real estate, investors can manage risk and potentially enhance returns. Diversification reduces the impact of a single investment's performance on the overall portfolio, providing a cushion against market fluctuations.

Short-term investment horizon:

A short-term investment horizon typically ranges from a few weeks to one year. Investors with a short-term perspective focus on preserving capital and achieving quick returns. They may have specific financial goals or opportunities that require them to liquidate their investments within a short timeframe.

One common short-term investment is cash and cash equivalents. These include savings accounts, money market funds, and certificates of deposit. Cash investments are considered the least risky asset class but offer lower potential returns compared to other investments. They provide easy access to funds and can be useful for emergencies or short-term financial needs.

Another short-term investment strategy is trading. Investors who engage in trading aim to profit from short-term price movements in various financial instruments, such as stocks, commodities, or currencies. Trading requires active monitoring of market trends and timely execution of buy and sell orders. It can be a more speculative approach, as short-term price fluctuations can be influenced by various factors.

What is the best investment horizon for you?

The choice of investment horizon depends on individual circumstances, financial goals, and risk tolerance. It is essential to align your investment strategy with your specific needs and objectives. Here are some factors to consider when determining the best investment horizon for you:

1. Financial goals: Clearly define your short, medium, and long-term financial goals. Are you saving for retirement, a down payment on a house, or a child's education? Identifying your goals will help you determine the appropriate investment horizon to achieve them.

2. Risk tolerance: Evaluate your risk tolerance and comfort level with market volatility. Longer-term horizons generally allow for greater exposure to asset classes with higher potential returns but higher short-term fluctuations.

3. Time commitment: Assess the amount of time you can commit to managing your investments. Longer-term investments are generally less time-intensive, as they require less active monitoring and trading compared to short-term strategies.

4. Liquidity needs: Consider your liquidity requirements. If you anticipate needing quick access to funds for a specific purpose, a short or medium-term investment horizon may be more suitable.

Tips for managing your investments:

Regardless of your investment horizon, here are some tips to help you manage your investments effectively:

1. Diversify your portfolio: Spread your investments across different asset classes to reduce risk and potentially enhance returns. A well-diversified portfolio should include a mix of stocks, bonds, and other asset classes based on your risk profile.

2. Regularly review and rebalance: Monitor your investments regularly and adjust your portfolio if needed. As market conditions change, the performance of individual investments may deviate from your target allocation. Rebalancing helps maintain the desired asset allocation.

3. Stay informed: Keep up to date with financial news and developments that may impact your investments. Understanding economic trends, industry developments, and specific company news can provide valuable insights for decision-making.

4. Seek professional advice: Consider consulting with a financial advisor who can provide personalized guidance based on your specific circumstances and goals. A professional advisor can help you develop a tailored investment strategy and navigate complex investment decisions.

Recommendation:

Irrespective of the investment horizon you choose, it is important to have a robust plan in place. A goal-based investment approach can help you align your investment horizon with specific financial goals and create a roadmap for achieving them. Start by clearly defining your objectives, assessing your risk tolerance, and developing an appropriate asset allocation strategy. Regularly review and adjust your investments to ensure they remain aligned with your evolving needs and market conditions.

Listicle of investment horizon strategies:

Here are five investment strategies tailored to different investment horizons:

1. Long-term growth strategy: Invest primarily in equities and equity-oriented funds to capitalize on long-term growth potential. This strategy is suitable for investors with a long-term horizon and high tolerance for volatility.

2. Income generation strategy: Focus on fixed-income assets and dividend-paying stocks to generate regular income. This strategy suits investors with a medium-term horizon and a need for stable income.

3. Defensive strategy: Allocate a significant portion of your portfolio to low-risk assets such as cash, government bonds, and defensive stocks. This strategy is suitable for short-term horizons and conservative investors.

4. Balanced strategy: Create a diversified portfolio with a mix of equities, bonds, and alternative investments. This strategy aims to achieve a balance between risk and return and is suitable for medium-term horizons.

5. Tactical asset allocation strategy: Adjust your asset allocation based on market conditions and short-term opportunities. This strategy requires active monitoring and is suitable for experienced and hands-on investors.

Question & Answer:

Q: Can I change my investment horizon?

A: Yes, investment horizons can be adjusted based on changing circumstances or evolving financial goals. It is important to periodically review your investments and reassess your goals to ensure your strategy remains aligned with your needs.

Q: Is a long-term investment horizon always better?

A: A long-term investment horizon can be beneficial for many investors due to the potential for higher returns from growth assets like stocks. However, individual circumstances and preferences vary, and it's important to choose an investment horizon that suits your financial goals and risk tolerance.

Q: What are the risks associated with short-term investments?

A: Short-term investments can be subject to significant volatility and market fluctuations. Additionally, short-term investments may offer lower potential returns compared to long-term strategies. It is important to carefully assess and manage the risks associated with short-term investments.

Summary:

The investment horizon you choose is a critical factor in your investment strategy. Whether you opt for a long-term, medium-term, or short-term perspective, it should align with your financial goals, risk tolerance, and liquidity needs. A well-balanced and diversified portfolio, along with regular reviews and adjustments, can help you make the most of your chosen investment horizon. Seek professional advice if needed, and remember that your investment horizon can be adjusted as your circumstances change.

Post a Comment for "Investment Horizons: Discovering New Frontiers Of Wealth"