Investment Horizons: Expanding Your Wealth Possibilities

Investing is an essential component of financial planning that individuals should consider for long-term wealth creation. It provides an opportunity to grow your money and achieve your financial goals. Understanding the different types of investment horizons can help you make informed decisions based on your needs and objectives.

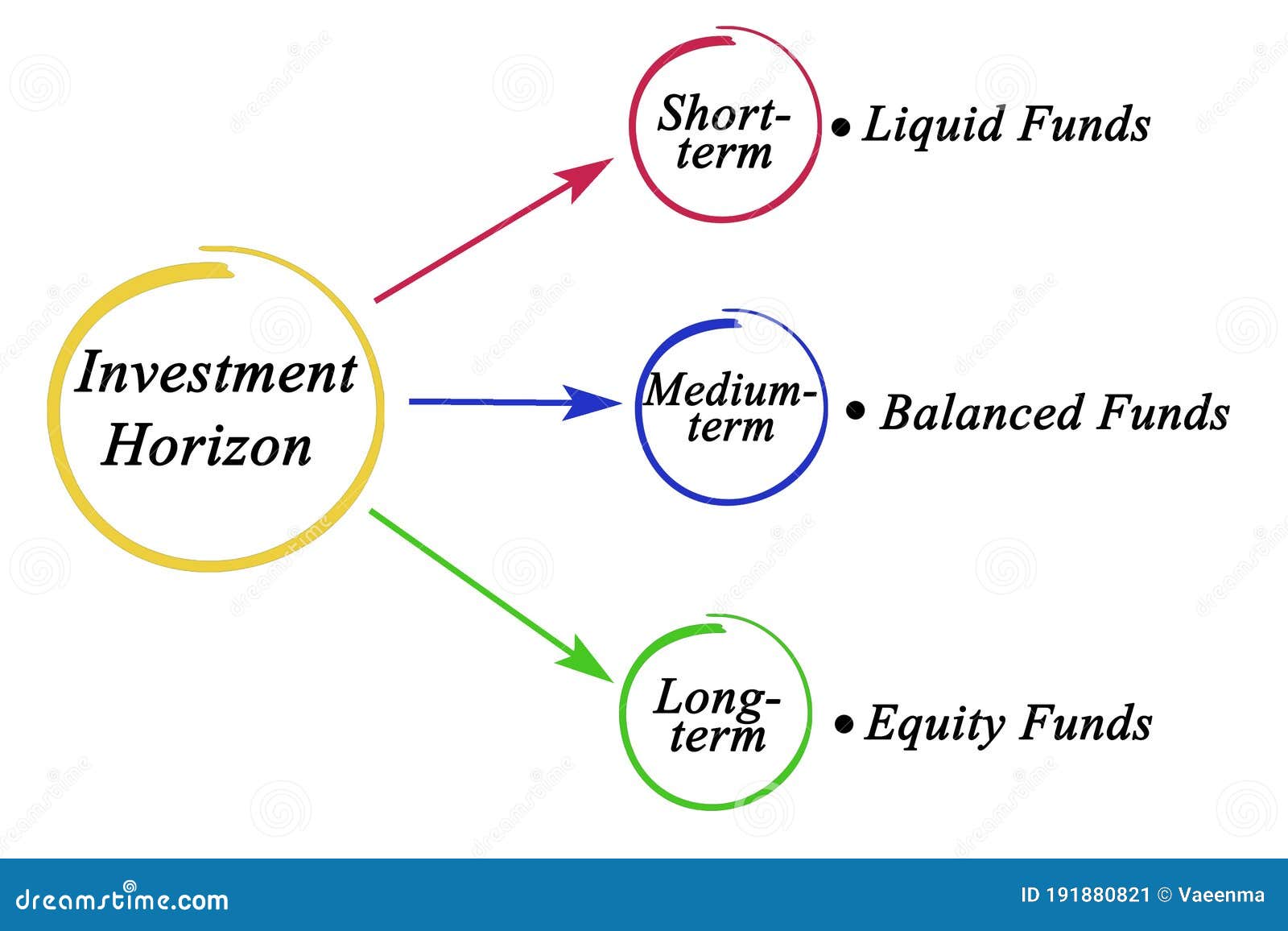

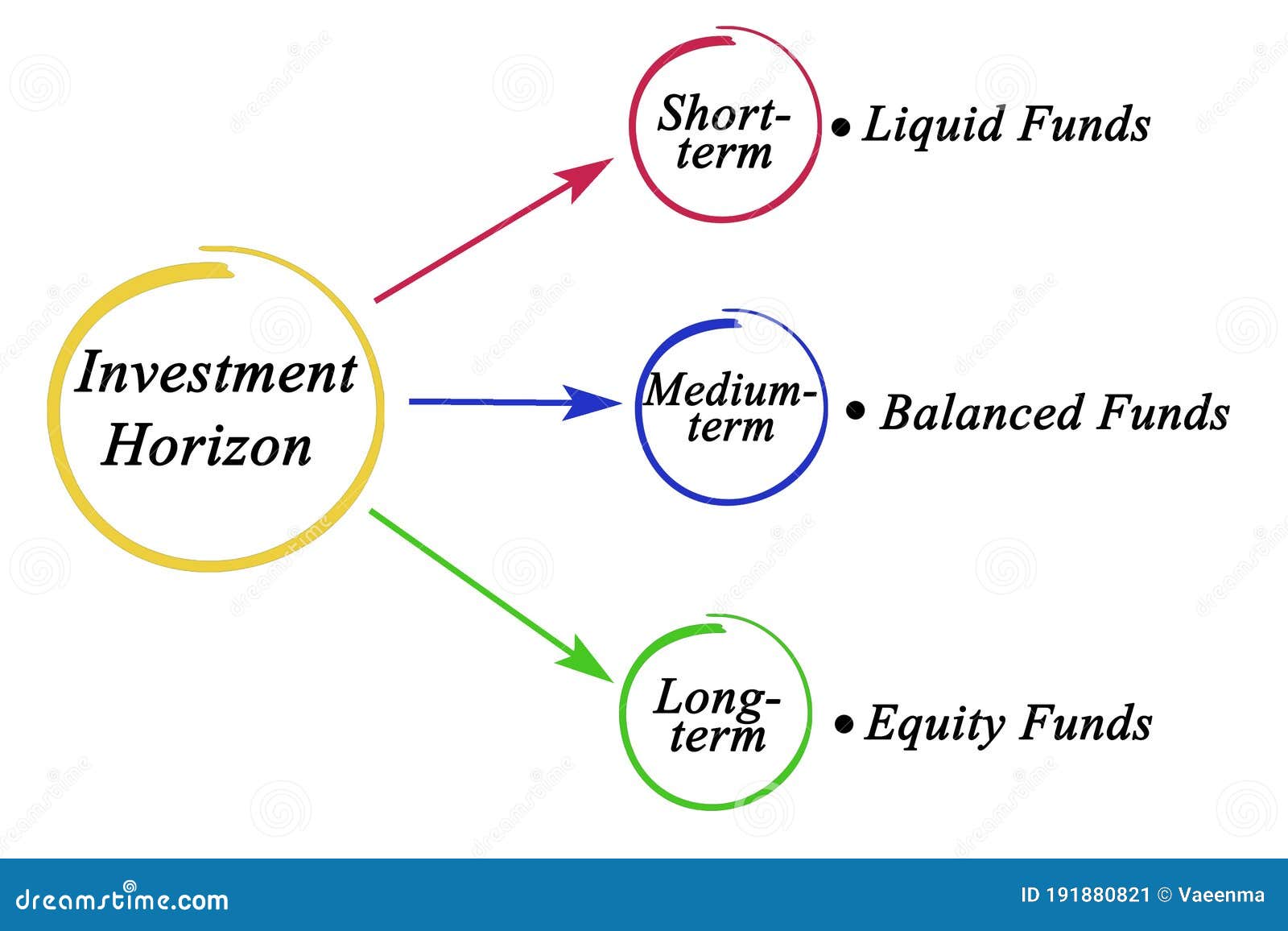

When it comes to investing, there are three primary types of investment horizons: short-term, medium-term, and long-term. Each has its own characteristics and considerations that investors should be aware of.

Short-Term Investment Horizon

A short-term investment horizon typically refers to an investment time frame of less than one year. Investors with a short-term horizon are focused on generating immediate returns and typically have low tolerance for risk. Some common examples of short-term investment options include savings accounts, money market funds, and certificates of deposit.

Tips For Short-Term Investing:

1. Set clear financial goals for your short-term investments to determine your investment strategy.

2. Consider diversifying your short-term investment portfolio to minimize risk.

3. Regularly review your investments and adjust your strategy if needed.

4. Keep track of interest rates and market conditions that may affect your short-term investments.

Recommendation:

For individuals with a short-term investment horizon, it is advisable to focus on low-risk and highly liquid investment options. Bank savings accounts and short-term bond funds can provide modest returns while ensuring easy access to your funds.

Medium-Term Investment Horizon

A medium-term investment horizon typically refers to an investment time frame of one to five years. Investors with a medium-term horizon often have different financial goals such as saving for a down payment on a house or funding their child's education. This investment horizon allows investors to take on some level of risk while still providing potential for growth. Examples of medium-term investment options include corporate bonds, balanced mutual funds, and peer-to-peer lending.

Tips For Medium-Term Investing:

1. Define your financial goals and invest accordingly.

2. Consider a diversified portfolio with a mix of stocks, bonds, and cash equivalents.

3. Regularly review your investments and make adjustments based on market conditions and changing goals.

4. Be prepared for some level of volatility and fluctuations in your investments.

Recommendation:

Individuals with a medium-term investment horizon may benefit from investing in a combination of stocks and bonds through mutual funds. These funds offer diversification and potential growth while managing risk.

Long-Term Investment Horizon

A long-term investment horizon typically refers to an investment time frame of more than five years. Investors with a long-term horizon have the advantage of utilizing compound interest and can afford to ride out short-term market fluctuations. This investment horizon is suitable for individuals saving for retirement or long-term financial goals. Examples of long-term investment options include stocks, real estate investment trusts (REITs), and retirement accounts like a 401(k) or an Individual Retirement Account (IRA).

Tips For Long-Term Investing:

1. Start early and stay committed to your long-term investment plan.

2. Diversify your portfolio across various asset classes to minimize risk.

3. Take advantage of tax-advantaged retirement accounts to maximize your savings.

4. Be patient and avoid making impulsive decisions based on short-term market movements.

Recommendation:

For individuals with a long-term investment horizon, it is advisable to consider a mix of stocks and bonds through index funds or exchange-traded funds (ETFs). These investments provide broad market exposure and have historically shown potential for long-term growth.

Listicle of Investment Horizon:

1. Short-Term: Savings accounts, money market funds, certificates of deposit.

2. Medium-Term: Corporate bonds, balanced mutual funds, peer-to-peer lending.

3. Long-Term: Stocks, real estate investment trusts (REITs), retirement accounts.

Question & Answer:

Q: Why is it important to identify your investment horizon?

A: Identifying your investment horizon helps you align your investment strategy with your financial goals and risk tolerance. It allows you to make informed decisions and choose investment options that are suitable for your specific needs.

Q: Can I change my investment horizon?

A: Yes, your investment horizon can change over time as your financial goals and circumstances evolve. It is important to periodically reassess your investment horizon and make adjustments accordingly.

Summary:

Understanding the different types of investment horizons is crucial for successful investing. Whether you have a short-term, medium-term, or long-term investment horizon, it is important to align your investment strategy with your financial goals and risk tolerance. Consider diversification, regularly review your portfolio, and make informed investment decisions based on market conditions. By doing so, you can make the most of your investments and work towards achieving your financial objectives.

Post a Comment for "Investment Horizons: Expanding Your Wealth Possibilities"