Investment Horizons: Exploring New Opportunities For Growth

Investment is an essential aspect of financial planning and wealth accumulation. It allows individuals to allocate their funds in various financial instruments with the aim of generating returns over a specific period. Depending on one's investment horizon, different investment strategies can be pursued to achieve specific financial goals. In this article, we will explore the types of investment horizons and understand how they impact investment decisions.

But before we delve into the details, let's first define what an investment horizon is. In simple terms, an investment horizon refers to the duration of time an investor is willing to hold an investment before expecting to achieve a specific financial goal or objective. It can range from short-term to long-term, depending on the individual's financial aspirations and risk tolerance.

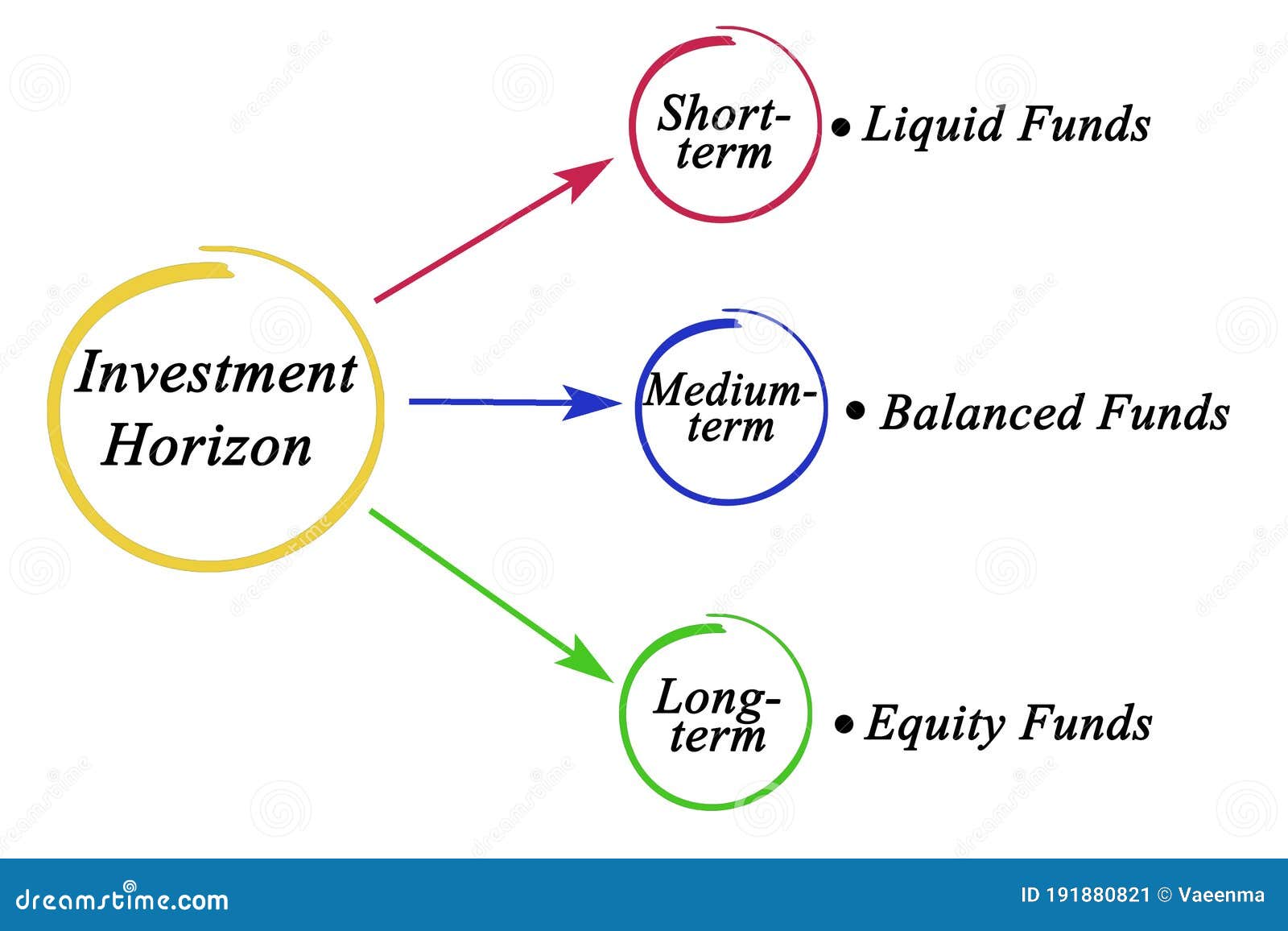

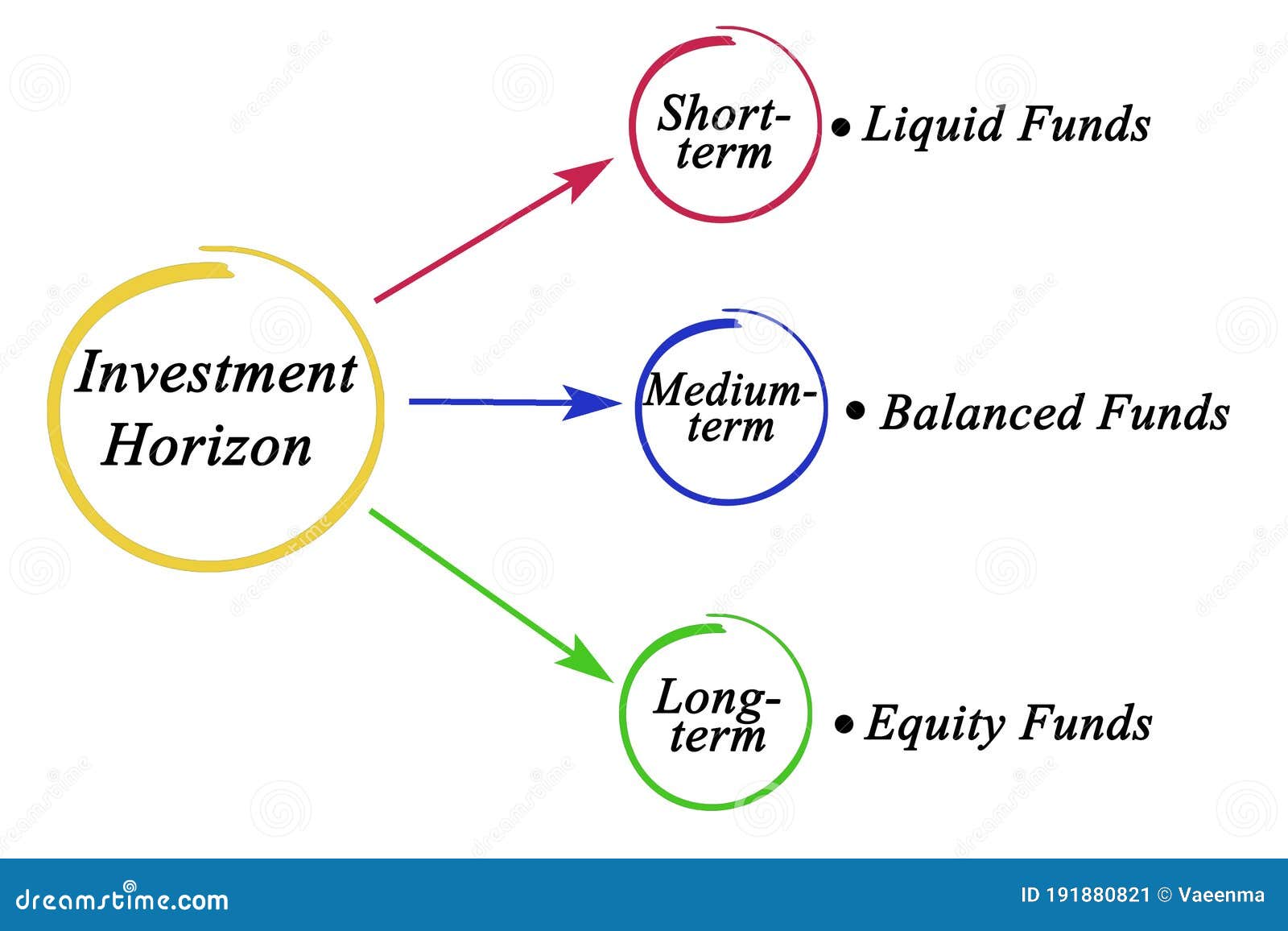

Now, let's take a closer look at the three main types of investment horizons:

Short-term Investment Horizon

A short-term investment horizon typically spans less than one year. Investors with a short-term horizon are primarily focused on preserving capital and generating modest returns in a relatively short period. They usually prefer low-risk investments such as money market funds, certificates of deposit, or government bonds, which offer stable returns with minimal volatility.

Short-term investments can be suitable for individuals who have immediate financial needs or who want to park their funds temporarily while they explore other investment opportunities. However, it's essential to be cautious with short-term investments as they may not offer significant returns compared to long-term investments.

Medium-term Investment Horizon

The medium-term investment horizon typically ranges from one to five years. Investors with a medium-term horizon have slightly more time to invest their funds and achieve their financial goals. They may be saving for a down payment on a house, a business venture, or their child's education.

With a medium-term investment horizon, investors can afford to take on slightly more risk and explore different asset classes such as stocks, bonds, or mutual funds. These investments have the potential to generate higher returns compared to short-term investments, but they also come with a higher level of volatility. Diversification is crucial during this timeframe to reduce risk and maximize potential returns.

Long-term Investment Horizon

On the other end of the spectrum, we have the long-term investment horizon, which extends beyond five years. Investors with a long-term horizon have the advantage of time when it comes to weathering market fluctuations and capitalizing on compounding returns.

For individuals planning for retirement, funding their children's education, or building substantial wealth, a long-term investment strategy is paramount. This horizon allows investors to harness the potential of higher-risk investments such as equities and real estate, which have historically proven to offer superior returns over extended periods.

Long-term investors can afford to ride out market downturns, as they have time on their side to recover from short-term losses. However, it's essential to note that long-term investments are not without risk, and thorough research and analysis should be conducted before making any investment decisions.

Now that we have explored the three types of investment horizons, let's take a look at some tips for successful investing:

Tips for Successful Investing

- Set Clear Financial Goals: Before diving into investments, it's crucial to establish clear financial goals and objectives. This will help guide your investment decisions and ensure that you are working towards achieving specific milestones.

- Understand Your Risk Tolerance: Every individual has a different risk tolerance level. It's important to assess your risk appetite and invest accordingly. Generally, higher risk is associated with higher potential returns, but it also comes with increased volatility.

- Consider Diversification: Diversifying your investment portfolio across different asset classes can help mitigate risk. By spreading your investments, you reduce the impact of a single investment's poor performance on your overall portfolio.

- Stay Informed: Keep up-to-date with market trends, economic news, and investment strategies. This knowledge will enable you to make informed investment decisions and adapt to changing market conditions.

- Monitor and Review Your Portfolio: Regularly review your investment portfolio to ensure it aligns with your financial goals and remains in line with your risk tolerance. Rebalance your portfolio if necessary to maintain a diversified and well-aligned investment strategy.

- Invest for the Long Term: As mentioned earlier, a long-term investment horizon offers the potential for higher returns. Resist the temptation to time the market and focus on a disciplined, long-term investment approach.

- Seek Professional Advice: If you are unsure about investing or need assistance, consider consulting with a financial advisor. They can help you analyze your financial situation, define your goals, and create a tailored investment strategy.

- Stay Disciplined: Investing requires discipline and a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations and remain committed to your investment plan.

With these tips in mind, let's explore some investment recommendations for each type of investment horizon:

Recommendations by Investment Horizon

Short-term:

For individuals with a short-term investment horizon, the focus is on capital preservation and liquidity. Here are some investment options to consider:

- Money Market Funds

- Certificates of Deposit (CDs)

- Government or Treasury Bonds

- High-Yield Savings Account

- Short-term Corporate Bonds

Medium-term:

Investors with a medium-term investment horizon can consider slightly more aggressive investments that offer potential growth over a longer timeframe. Here are some options:

- Diversified Stock Market Index Funds

- Balanced Mutual Funds

- Corporate Bonds

- Real Estate Investment Trusts (REITs)

- Exchange-Traded Funds (ETFs)

Long-term:

Long-term investors have the luxury of taking on higher-risk investments in pursuit of substantial growth over the years. Here are some investment options for long-term horizons:

- Individual Stocks

- Stock Market Index Funds

- Mutual Funds

- Real Estate

- Retirement Accounts (401(k), IRA)

It's important to note that these recommendations are not one-size-fits-all solutions and should be considered as starting points for further research and analysis based on individual financial goals and risk tolerance.

Listicle of Investment Horizons

Now, let's break down each investment horizon into a listicle format, summarizing their key characteristics:

1. Short-term Investment Horizon:

- Duration: Less than one year

- Main Consideration: Capital preservation and liquidity

- Recommended Investments: Money Market Funds, CDs, Government Bonds

- Primary Objective: Protect invested capital and generate modest returns

2. Medium-term Investment Horizon:

- Duration: One to five years

- Main Consideration: Moderate growth potential with higher risk

- Recommended Investments: Diversified Stock Market Index Funds, Balanced Mutual Funds

- Primary Objective: Achieve growth for specific financial goals

3. Long-term Investment Horizon:

- Duration: More than five years

- Main Consideration: Higher risk tolerance for higher potential returns

- Recommended Investments: Individual Stocks, Mutual Funds, Real Estate

- Primary Objective: Build substantial wealth over an extended period

By understanding the different investment horizons, considering individual risk appetite, and aligning investments with specific financial goals, individuals can make informed investment decisions that support their long-term financial well-being.

Question & Answer: Investment Horizons

Q: Can I change my investment horizon?

A: Yes, your investment horizon can change as your financial goals and circumstances evolve. It's important to regularly review and adjust your investment strategy to align with your changing needs.

Q: How do I determine my risk tolerance?

A: Assessing your risk tolerance involves examining your ability to withstand market fluctuations and financial setbacks. Factors such as your age, income level, financial obligations, and investment knowledge can influence your risk tolerance.

Q: Are there any investment horizons that are risk-free?

A: No investment is entirely risk-free. However, short-term investments like money market funds and government bonds are generally considered less risky compared to long-term equity investments.

Q: Can I have multiple investment horizons?

A: Yes, it's possible to have multiple investment horizons. Many individuals allocate their funds across different investment options based on various financial goals and timeframes.

Summary

Investment horizons play a crucial role in shaping one's investment strategy. The duration of time an investor is willing to commit can greatly impact the choice of investment vehicles and the potential returns. Short-term investors prioritize capital preservation, while medium-term investors seek growth over a few years. Long-term investors harness the power of compounding returns to build substantial wealth over time.

Regardless of your investment horizon, it's essential to set clear financial goals, understand your risk tolerance, diversify your portfolio, and stay informed about market trends. By following these guidelines and tailoring investment decisions to your specific needs, you increase the likelihood of achieving your financial aspirations.

Remember, investing is a long-term journey, and careful planning and patience are key ingredients for success.

Post a Comment for "Investment Horizons: Exploring New Opportunities For Growth"